Regulatory Pressures

The bfsi security market is significantly influenced by stringent regulatory requirements imposed by UK authorities. Regulations such as the General Data Protection Regulation (GDPR) and the Financial Services and Markets Act necessitate robust security frameworks. Non-compliance can lead to hefty fines, which can reach up to £17 million or 4% of annual global turnover, whichever is higher. Consequently, financial institutions are compelled to enhance their security protocols, leading to increased spending on compliance-related technologies. This regulatory environment is expected to propel the bfsi security market, as firms seek to mitigate risks associated with non-compliance.

Rising Cyber Threats

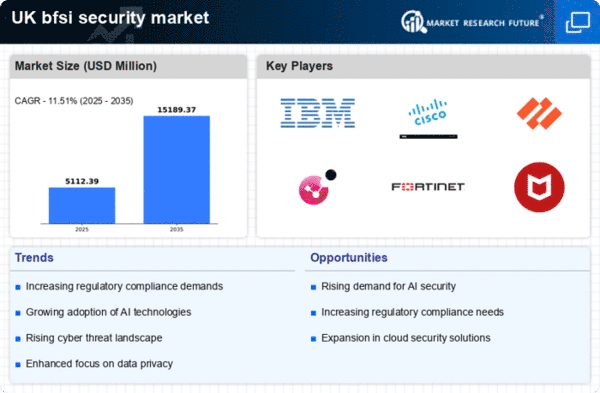

The bfsi security market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Financial institutions in the UK are particularly vulnerable, with reports indicating that cybercrime costs the sector approximately £27 billion annually. This alarming trend compels banks and financial service providers to invest significantly in advanced security measures. As a result, the bfsi security market is projected to grow at a CAGR of 10.5% over the next five years. The urgency to protect sensitive customer data and maintain trust is driving investments in cybersecurity solutions, thereby shaping the market landscape.

Shift to Digital Banking

The ongoing shift towards digital banking is reshaping the bfsi security market in the UK. As more consumers opt for online and mobile banking solutions, the need for enhanced security measures becomes paramount. Reports indicate that over 70% of UK adults now use online banking services, which exposes them to various cyber threats. Consequently, financial institutions are investing heavily in security technologies to protect their digital platforms. This trend is expected to drive the bfsi security market, as firms seek to secure their digital infrastructures against potential breaches and ensure a safe banking experience for their customers.

Technological Advancements

The bfsi security market is being transformed by rapid technological advancements, particularly in areas such as encryption, biometrics, and blockchain. These innovations are essential for safeguarding financial transactions and customer data. For instance, the adoption of biometric authentication methods is projected to increase by 30% in the next few years, as institutions seek to enhance security while improving user experience. Furthermore, the integration of blockchain technology is anticipated to revolutionise transaction security, reducing fraud and enhancing transparency. Such advancements are likely to drive growth in the bfsi security market, as firms invest in cutting-edge solutions.

Increased Consumer Awareness

Consumer awareness regarding data privacy and security is on the rise, significantly impacting the bfsi security market. UK customers are becoming more informed about their rights and the importance of data protection, leading to heightened expectations from financial institutions. This shift in consumer behaviour is prompting banks to adopt more robust security measures to maintain customer trust and loyalty. As a result, the bfsi security market is likely to see an increase in demand for transparent security practices and technologies that ensure data integrity. Institutions that fail to meet these expectations may face reputational damage and loss of clientele.