Surge in Cyber Threats

The bfsi security market in France is currently experiencing a surge in cyber threats, which is driving the demand for enhanced security measures. With the increasing sophistication of cyber attacks, financial institutions are compelled to invest in advanced security solutions. Reports indicate that cybercrime costs the financial sector in France approximately €1.5 billion annually. This alarming figure underscores the urgency for robust security frameworks. As a result, the bfsi security market is witnessing a significant uptick in the adoption of technologies such as intrusion detection systems and advanced encryption methods. Financial institutions are prioritizing investments in cybersecurity to safeguard sensitive customer data and maintain trust. The growing awareness of potential vulnerabilities is likely to propel the market further, as organizations seek to mitigate risks associated with cyber threats.

Regulatory Landscape Evolution

The evolving regulatory landscape in France is significantly influencing the bfsi security market. Financial institutions are required to comply with stringent regulations aimed at protecting consumer data and ensuring financial stability. The implementation of the General Data Protection Regulation (GDPR) has heightened the focus on data privacy, compelling organizations to enhance their security frameworks. Non-compliance can result in hefty fines, which can reach up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory pressure is driving investments in security technologies and services, as institutions strive to meet compliance requirements. The bfsi security market is thus witnessing a shift towards solutions that not only address security concerns but also ensure adherence to regulatory mandates, fostering a culture of accountability and transparency.

Growing Awareness of Data Privacy

There is a growing awareness of data privacy among consumers in France, which is significantly impacting the bfsi security market. As individuals become more informed about their rights regarding personal data, financial institutions are under increasing pressure to implement stringent security measures. Surveys indicate that over 70% of consumers prioritize data protection when choosing a financial service provider. This heightened awareness is prompting institutions to invest in advanced security technologies to build trust and retain customers. The bfsi security market is thus evolving to meet these expectations, with a focus on transparency and accountability in data handling practices. As organizations strive to align with consumer demands, the emphasis on data privacy is likely to drive innovation and investment in security solutions.

Technological Advancements in Security

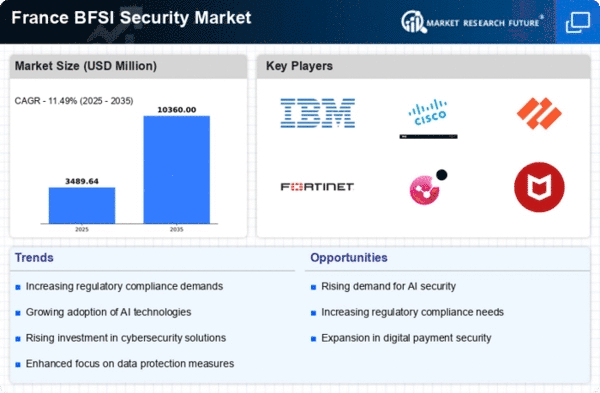

Technological advancements are playing a pivotal role in shaping the bfsi security market in France. Innovations such as biometric authentication, machine learning, and blockchain technology are being integrated into security protocols to enhance protection against fraud and data breaches. The market is projected to grow at a CAGR of 10% over the next five years, driven by these technological innovations. Financial institutions are increasingly adopting these advanced solutions to streamline operations and improve security measures. The integration of artificial intelligence in fraud detection systems is particularly noteworthy, as it allows for real-time monitoring and response to suspicious activities. This trend indicates a shift towards more proactive security measures, which are essential in an era where cyber threats are becoming more prevalent.

Increased Investment in Digital Transformation

The ongoing digital transformation across the financial sector is a key driver for the bfsi security market in France. As institutions increasingly adopt digital channels for customer engagement and service delivery, the need for robust security measures becomes paramount. Investments in digital banking solutions, mobile applications, and online platforms are expected to reach €10 billion by 2026. This shift necessitates the implementation of comprehensive security strategies to protect against potential vulnerabilities associated with digital transactions. Consequently, the bfsi security market is likely to see a rise in demand for solutions that address the unique challenges posed by digital transformation, including secure payment gateways and identity verification systems. The focus on enhancing customer experience while ensuring security is likely to shape the future landscape of the market.