Rising Cyber Threats

The Cyber Security in BFSI Market is increasingly driven by the rise in cyber threats, which have become more sophisticated and frequent. Financial institutions are prime targets for cybercriminals due to the sensitive nature of the data they handle. Reports indicate that the number of cyberattacks on financial institutions has surged, with a notable increase in ransomware attacks. This escalation compels organizations to invest heavily in robust cybersecurity measures to protect their assets and customer information. As a result, the demand for advanced cybersecurity solutions is expected to grow, with the market projected to reach substantial figures in the coming years. The urgency to safeguard against these threats is a key factor propelling the Cyber Security in BFSI Market.

Increased Digital Transformation

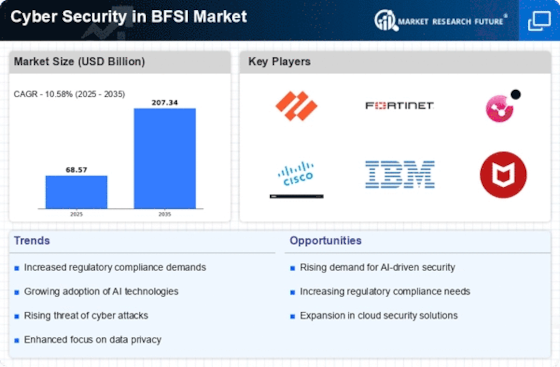

The ongoing digital transformation within the BFSI sector is a significant driver of the Cyber Security in BFSI Market. As financial institutions increasingly adopt digital channels for customer engagement and service delivery, the attack surface for cyber threats expands. This shift necessitates enhanced cybersecurity measures to protect digital assets and customer data. The rise of mobile banking, online transactions, and digital wallets has led to a corresponding increase in cybersecurity investments. According to recent estimates, the cybersecurity market in the BFSI sector is projected to grow at a compound annual growth rate (CAGR) of over 10% in the next few years. This trend underscores the critical importance of cybersecurity in supporting the digital initiatives of financial institutions, thereby propelling the Cyber Security in BFSI Market.

Regulatory Compliance Requirements

Regulatory compliance is a critical driver in the Cyber Security in BFSI Market. Financial institutions are subject to stringent regulations aimed at protecting consumer data and ensuring the integrity of financial systems. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) necessitates significant investment in cybersecurity infrastructure. Non-compliance can lead to severe penalties, which further incentivizes organizations to enhance their cybersecurity posture. The increasing complexity of regulatory frameworks is likely to drive demand for specialized cybersecurity solutions that can help institutions meet these requirements effectively. Consequently, the Cyber Security in BFSI Market is expected to witness robust growth as firms seek to align with evolving regulatory standards.

Growing Awareness of Cybersecurity Risks

Growing awareness of cybersecurity risks among consumers and businesses is a crucial driver in the Cyber Security in BFSI Market. As high-profile data breaches and cyberattacks make headlines, stakeholders are becoming increasingly cognizant of the potential repercussions of inadequate cybersecurity measures. This heightened awareness is prompting financial institutions to prioritize cybersecurity investments to maintain customer trust and protect their reputations. Additionally, educational initiatives aimed at informing employees and customers about cybersecurity best practices are gaining traction. The demand for comprehensive cybersecurity solutions is likely to rise as organizations seek to mitigate risks and enhance their security frameworks. This trend is expected to contribute to the overall growth of the Cyber Security in BFSI Market.

Technological Advancements in Cybersecurity

Technological advancements play a pivotal role in shaping the Cyber Security in BFSI Market. Innovations such as artificial intelligence, machine learning, and blockchain technology are being integrated into cybersecurity solutions to enhance threat detection and response capabilities. These technologies enable financial institutions to analyze vast amounts of data in real-time, identifying potential threats before they can cause harm. The market for AI-driven cybersecurity solutions is anticipated to grow significantly, as organizations recognize the need for proactive measures against cyber threats. Furthermore, the integration of these advanced technologies is likely to improve the overall efficiency and effectiveness of cybersecurity strategies within the BFSI sector, thereby driving the Cyber Security in BFSI Market forward.