Top Industry Leaders in the Methacrylate Monomers Market

The global methacrylate monomers market is fueled by a vibrant mix of factors: rising demand from construction, automotive, and packaging industries, the superior properties of acrylics like strength, clarity, and weatherability, and the growing adoption of sustainable alternatives. However, beneath this seemingly idyllic surface, the competitive landscape is a complex interplay of strategies, market dynamics, and recent developments. Let's delve into the world of methacrylate monomers, exploring the key strategies, factors shaping market share, industry news, and the latest trends that have been shaping this market over the past six months.

Strategies Shaping the Market:

-

Product Innovation: Leading players like Mitsubishi Chemical, Lucite International, and Evonik are constantly pushing the boundaries, developing new methacrylate monomers with enhanced properties like heat resistance, flame retardancy, and improved biodegradability. -

Vertical Integration: Some players are pursuing vertical integration, expanding into production of downstream acrylic products like sheets and resins, securing control over the entire value chain. -

Geographical Expansion: Emerging markets like China, India, and Southeast Asia offer immense potential. Companies are establishing production facilities and distribution networks in these regions to capture the growing demand. -

Sustainability Focus: With environmental concerns on the rise, sustainable production processes and bio-based methacrylate monomers are gaining traction. Companies are investing in renewable feedstocks and cleaner manufacturing technologies. -

Partnerships and Acquisitions: Strategic partnerships and acquisitions are a common strategy to access new technologies, market share, and geographical reach.

Factors Dictating Market Share:

-

Production Capacity and Technology: Companies with large production capacities and access to advanced technologies can cater to diverse customer needs and offer competitive pricing. -

Brand Reputation and Customer Relationships: Established brands with strong reputations and long-standing customer relationships often enjoy market loyalty and a larger share of the pie. -

Product Portfolio Diversity: A diverse portfolio catering to various applications like coatings, adhesives, and biomedical materials allows companies to attract a wider customer base. -

Cost Competitiveness: The highly competitive nature of the market necessitates efficient production processes and competitive pricing strategies to secure market share. -

Compliance with Regulations: Meeting stringent environmental and safety regulations, particularly in Europe and North America, is crucial for market access and customer trust.

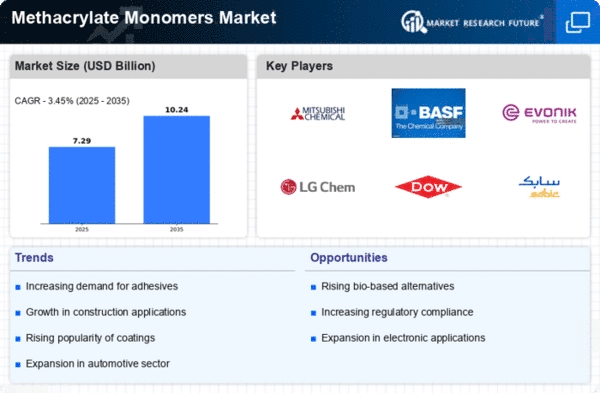

Key Players:

- Mitsubishi Rayon Co. Ltd (Japan),

- Sumitomo Chemical Co., Ltd (Japan),

- Chi Mei Corporation (Taiwan),

- Arkema Group (Europe),

- BASF SE (Germany),

- Evonik Industries (Germany),

- The Dow Chemical Company (US),

- Lucite International (UK),

- Eastman Chemical Company (US)

Recent Developments:

-

September 2023: Several methacrylate monomer producers announced price increases due to rising raw material costs and supply chain disruptions. -

October 2023: The American Coatings Association hosted its annual conference, focusing on advancements in acrylic technology, sustainability initiatives, and market trends in the coatings industry. -

November 2023: A global study highlighted the potential of functionalized methacrylate monomers that can impart unique properties like self-healing or conductivity to acrylics, opening up new avenues for material design and functionality. -

December 2023: The Chinese government announced plans to invest in the development of advanced methacrylate monomer production technologies, aiming to strengthen domestic production and compete with global players.