Growing Aerospace Industry

The aerospace industry is emerging as a crucial driver for the Metal Forging Market, with an increasing need for lightweight and high-strength materials. As air travel continues to expand, manufacturers are focusing on producing forged components that enhance aircraft performance and safety. The aerospace sector is projected to grow at a rate of around 5% annually, leading to heightened demand for forged parts such as landing gear and engine components. This growth indicates a promising future for the Metal Forging Market, as companies adapt to the specific requirements of aerospace applications, including weight reduction and improved fuel efficiency. The collaboration between aerospace manufacturers and forging companies is likely to foster innovation and drive market expansion.

Rising Demand in Automotive Sector

The automotive sector is a primary driver for the Metal Forging Market, as it increasingly relies on forged components for enhanced performance and durability. With the automotive industry projected to grow at a compound annual growth rate of approximately 4% over the next few years, the demand for high-strength, lightweight materials is expected to rise. Forged parts, such as crankshafts and connecting rods, are essential for improving fuel efficiency and reducing emissions. This trend indicates a robust market for metal forging, as manufacturers seek to innovate and meet stringent regulatory standards. The Metal Forging Market is likely to benefit from this growing demand, as automotive manufacturers prioritize quality and performance in their production processes.

Increased Focus on Energy Efficiency

An increased focus on energy efficiency across various industries is propelling the Metal Forging Market forward. As companies strive to reduce their carbon footprint and comply with environmental regulations, the demand for energy-efficient forged components is on the rise. Industries such as oil and gas, renewable energy, and manufacturing are seeking high-performance forged products that contribute to energy savings and sustainability. The market for energy-efficient technologies is expected to grow significantly, with forged components playing a pivotal role in optimizing performance. This trend suggests that the Metal Forging Market will experience growth as manufacturers innovate to meet the evolving needs of energy-conscious consumers and industries.

Infrastructure Development Initiatives

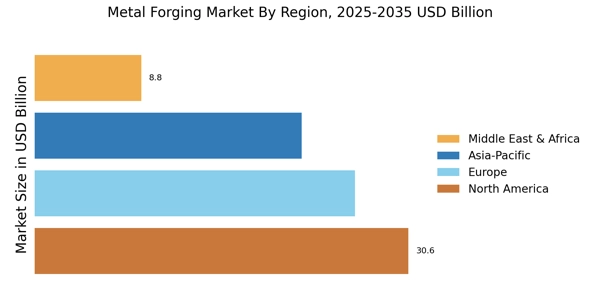

Infrastructure development initiatives are significantly influencing the Metal Forging Market, particularly in regions where urbanization is accelerating. Governments are investing heavily in infrastructure projects, including bridges, roads, and railways, which require high-quality forged components for structural integrity and longevity. The Metal Forging Market is expected to reach trillions of dollars in the coming years, creating substantial opportunities for metal forging companies. Forged steel and aluminum components are vital for construction equipment and machinery, which are essential for these projects. As such, the Metal Forging Market stands to gain from increased demand driven by infrastructure investments, potentially leading to a surge in production and innovation.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are reshaping the Metal Forging Market, enhancing efficiency and product quality. Advanced techniques such as computer numerical control (CNC) machining and automation are being integrated into forging operations, allowing for precise and consistent production of complex components. The adoption of these technologies is expected to increase productivity by up to 30%, thereby reducing costs and lead times. Furthermore, innovations in materials science, such as the development of high-performance alloys, are expanding the range of applications for forged products. This evolution suggests that the Metal Forging Market will continue to thrive as manufacturers leverage technology to meet the growing demands of various sectors, including aerospace and energy.