Energy Sector Growth

The energy sector, particularly renewable energy, is emerging as a vital driver for the metal forging market in North America. With the increasing focus on sustainable energy sources, the demand for forged components in wind turbines, solar panels, and other renewable technologies is likely to grow. In 2025, investments in renewable energy infrastructure are expected to exceed $200 billion, creating a substantial market for forged products. The metal forging market is positioned to capitalize on this trend, as forged components are essential for the structural integrity and efficiency of energy systems. Additionally, the transition towards cleaner energy solutions may prompt innovations in forging processes, further enhancing the market's potential. As such, the growth of the energy sector is anticipated to significantly impact the demand for forged materials.

Aerospace Industry Expansion

The aerospace sector is a significant contributor to the metal forging market in North America. As air travel continues to recover and expand, the demand for aircraft components is expected to rise. In 2025, the North American aerospace industry is projected to generate revenues exceeding $300 billion, with a considerable portion attributed to the procurement of forged parts. The metal forging market is likely to benefit from this growth, as forged components are critical for ensuring the safety and performance of aircraft. Furthermore, advancements in aerospace technology may lead to the development of new alloys and forging techniques, enhancing the capabilities of forged products. This expansion in the aerospace sector is anticipated to create opportunities for manufacturers to innovate and meet the evolving needs of the industry.

Rising Automotive Production

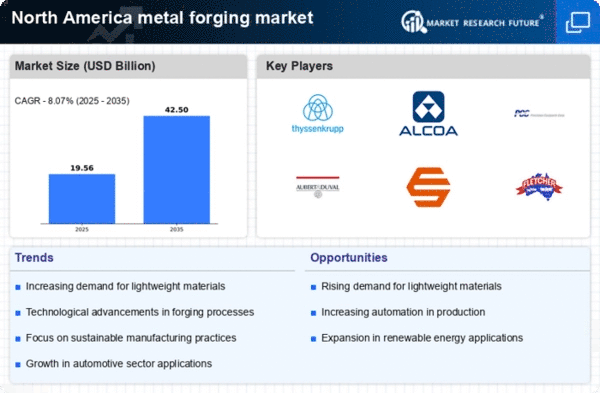

The automotive sector is a primary driver for the metal forging market in North America. With the increasing production of vehicles, the demand for forged components is expected to rise. In 2025, the automotive industry is projected to contribute approximately $1 trillion to the North American economy, with a significant portion allocated to manufacturing processes that utilize metal forging. This trend is likely to enhance the need for high-strength, lightweight materials, which are essential for improving fuel efficiency and performance. As automakers focus on innovation and sustainability, the metal forging market is poised to benefit from the shift towards electric vehicles, which require specialized forged parts. Consequently, the growth in automotive production is anticipated to stimulate investments in forging technologies, thereby expanding the market's capacity and capabilities.

Infrastructure Development Initiatives

Infrastructure development is a crucial factor influencing the metal forging market in North America. With government initiatives aimed at enhancing transportation networks, energy systems, and public facilities, the demand for forged metal components is likely to surge. In 2025, infrastructure spending in the U.S. is expected to reach $1.5 trillion, creating a substantial market for forged products used in construction and maintenance. The metal forging market stands to gain from this trend, as forged components are essential for structural integrity and durability in infrastructure projects. Additionally, the push for modernization and resilience in infrastructure systems may lead to increased adoption of advanced forging techniques, further driving market growth. As such, the ongoing infrastructure development initiatives are anticipated to create a robust demand for high-quality forged materials.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are playing a pivotal role in shaping the metal forging market in North America. The adoption of automation, artificial intelligence, and advanced materials is likely to enhance production efficiency and product quality. In 2025, the market for smart manufacturing technologies is projected to reach $500 billion, indicating a strong trend towards modernization in the manufacturing sector. The metal forging market stands to benefit from these innovations, as they enable manufacturers to produce complex geometries and improve material properties. Furthermore, the integration of Industry 4.0 principles may lead to more sustainable practices within the forging process, aligning with broader industry goals. As technological innovations continue to evolve, they are expected to drive growth and competitiveness in the metal forging market.