Mining Sector Growth

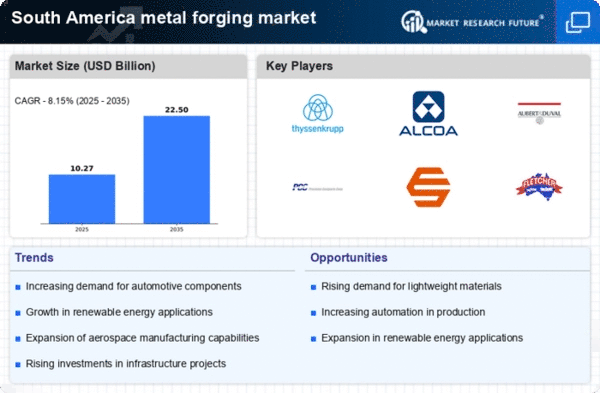

The mining sector in South America is a significant driver for the metal forging market, given the region's rich mineral resources. As mining operations expand, the demand for durable and reliable forged components, such as drill bits and machinery parts, is increasing. In 2025, the mining industry is expected to generate revenues exceeding $100 billion, with a substantial portion directed towards the procurement of forged materials. This growth is indicative of the metal forging market's potential to capitalize on the mining sector's needs, as manufacturers focus on producing high-quality, resilient products that can withstand the harsh conditions of mining operations. The synergy between these two industries suggests a promising outlook for the metal forging market in South America.

Energy Sector Expansion

The expansion of the energy sector in South America, particularly in renewable energy, is driving the metal forging market. As countries strive to meet their energy needs sustainably, investments in wind, solar, and hydroelectric power are increasing. These energy projects require specialized forged components, such as turbine blades and structural supports, which are essential for efficient energy production. In 2025, the renewable energy sector is expected to account for over 30% of the total energy mix in the region, creating a substantial demand for forged materials. This trend suggests that the metal forging market will benefit from the growing emphasis on sustainable energy solutions, as manufacturers adapt to meet the specific requirements of this evolving sector.

Aerospace Industry Demand

The aerospace industry in South America is emerging as a vital driver for the metal forging market. With the region's growing focus on aviation and space exploration, there is an increasing need for high-performance forged components. Aircraft manufacturers require lightweight yet strong materials for airframes and engines, which are often produced through forging processes. In 2025, the aerospace sector is anticipated to grow by 5% annually, leading to heightened demand for specialized forged products. This trend indicates that the metal forging market will play a crucial role in supporting the aerospace supply chain, as manufacturers strive to meet the stringent quality and performance standards required in this highly regulated sector.

Automotive Industry Growth

The automotive industry in South America is experiencing notable growth, which serves as a significant driver for the metal forging market. With an increasing number of automotive manufacturers establishing operations in the region, the demand for forged components is on the rise. In 2025, the automotive sector is projected to contribute approximately $50 billion to the South American economy, with a substantial portion allocated to the procurement of forged parts. These components are critical for enhancing vehicle performance and safety. As the automotive market continues to expand, the metal forging market is likely to see increased orders for high-strength forged materials, thereby fostering innovation and competitiveness among local manufacturers.

Infrastructure Development

The ongoing infrastructure development in South America is a crucial driver for the metal forging market. Governments are investing heavily in transportation, energy, and construction projects, which require high-quality forged components. For instance, the construction of new highways and bridges necessitates durable materials, leading to increased demand for forged steel and aluminum products. In 2025, the region's infrastructure spending is projected to reach approximately $200 billion, indicating a robust growth trajectory. This surge in infrastructure projects not only boosts the demand for metal forging but also encourages local manufacturers to enhance their production capabilities. Consequently, the metal forging market is likely to experience significant growth as it aligns with the broader economic development goals of South American nations.