Growing Aerospace Industry

The aerospace industry is a critical driver for the US Metal Forging Market, as it demands high-performance materials for aircraft manufacturing. In 2025, the aerospace sector is projected to account for approximately 20% of the total market share for forged components. The stringent safety and performance requirements in aerospace applications necessitate the use of forged materials, which offer superior strength and reliability. As air travel continues to expand, the US Metal Forging Market is expected to benefit from increased orders for forged parts, including landing gear and engine components, thereby bolstering overall market growth.

Rising Demand in Automotive Sector

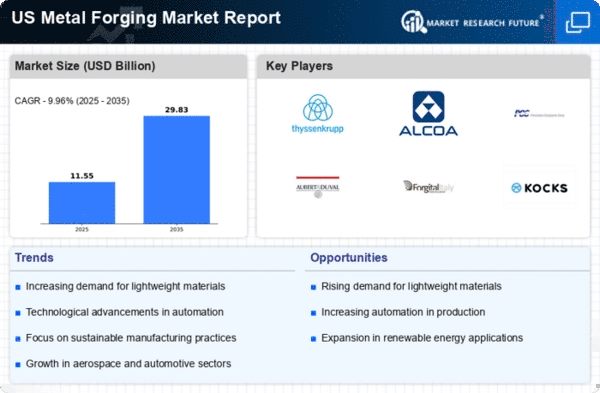

The US Metal Forging Market is experiencing a notable surge in demand, particularly from the automotive sector. As vehicle manufacturers increasingly prioritize lightweight materials to enhance fuel efficiency, the need for forged components has escalated. In 2025, the automotive industry is projected to account for approximately 30% of the total demand for forged products. This trend is driven by the ongoing shift towards electric vehicles, which require specialized forged parts for battery housings and structural components. Consequently, the US Metal Forging Market is likely to benefit from this growing demand, as manufacturers adapt their processes to meet the evolving needs of the automotive sector.

Increased Focus on Energy Efficiency

An increased focus on energy efficiency across various industries is influencing the US Metal Forging Market. As companies strive to reduce their carbon footprint and enhance sustainability, the demand for energy-efficient forged components is rising. In 2025, it is estimated that energy-efficient products will represent around 18% of the total market demand. This trend is particularly evident in sectors such as construction and manufacturing, where forged materials are utilized to create energy-efficient machinery and equipment. Consequently, the US Metal Forging Market is likely to see a shift towards the development of innovative forged solutions that align with energy efficiency goals.

Infrastructure Development Initiatives

Infrastructure development initiatives in the United States are poised to significantly impact the US Metal Forging Market. With the federal government allocating substantial funds for infrastructure projects, including bridges, roads, and railways, the demand for forged metal components is expected to rise. In 2025, it is estimated that infrastructure projects will contribute around 25% to the overall market growth. Forged products are essential for ensuring the durability and strength of these structures, making them indispensable in construction applications. As such, the US Metal Forging Market stands to gain from these investments, which are likely to stimulate demand for high-quality forged materials.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are transforming the US Metal Forging Market. Advancements such as computer numerical control (CNC) machining and automation are enhancing production efficiency and precision. In 2025, it is anticipated that these technologies will lead to a 15% increase in production capacity within the forging sector. This improvement not only reduces operational costs but also allows manufacturers to produce complex geometries that meet stringent industry standards. As a result, the US Metal Forging Market is likely to see a shift towards more sophisticated and high-performance forged products, catering to diverse applications across various sectors.