North America : Established Market with Growth Potential

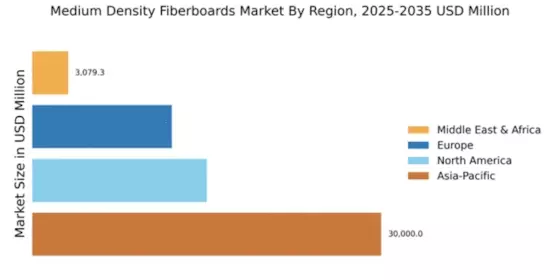

The North American Medium Density Fiberboards (MDF) market is poised for growth, driven by increasing demand in the construction and furniture sectors. With a market size of $15,000.0 million, the region benefits from a robust housing market and rising consumer preferences for sustainable materials. Regulatory support for eco-friendly products further enhances market dynamics, encouraging innovation and investment in MDF production. Leading countries like the US and Canada dominate the market, with key players such as Louisiana-Pacific Corporation and MDF Recovery driving competition. The presence of established manufacturers ensures a steady supply chain, while ongoing technological advancements in production processes are expected to enhance product quality and reduce costs. This competitive landscape positions North America as a significant player in The Medium Density Fiberboards.

Europe : Sustainable Practices Driving Growth

Europe's Medium Density Fiberboards (MDF) market, valued at $12,000.0 million, is characterized by a strong emphasis on sustainability and innovation. The region's growth is propelled by stringent regulations promoting eco-friendly materials and increasing consumer awareness regarding sustainable building practices. The demand for MDF in furniture and interior design applications is also on the rise, contributing to market expansion. Countries like Germany, France, and Italy are leading the charge, with key players such as Egger and Kronospan at the forefront. The competitive landscape is marked by a focus on product differentiation and sustainability, with manufacturers investing in advanced technologies to enhance production efficiency. This commitment to sustainable practices positions Europe as a leader in The Medium Density Fiberboards.

Asia-Pacific : Emerging Powerhouse in MDF Production

The Asia-Pacific region is the largest market for Medium Density Fiberboards (MDF), with a market size of $30,000.0 million. This growth is driven by rapid urbanization, increasing disposable incomes, and a booming construction industry. The region's demand for MDF is further supported by government initiatives promoting sustainable building materials, making it a key player in the global market. Leading countries such as China, India, and Japan are at the forefront of this growth, with major companies like Greenply Industries and Duratex contributing to the competitive landscape. The presence of numerous manufacturers ensures a diverse product range, catering to various consumer needs. As the region continues to invest in infrastructure and housing, the MDF market is expected to thrive, solidifying its position as a global leader.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa (MEA) region, with a market size of $3,079.3 million, is witnessing gradual growth in the Medium Density Fiberboards (MDF) market. This growth is driven by increasing construction activities and a rising demand for affordable housing solutions. Regulatory frameworks promoting sustainable building practices are also contributing to the market's development, creating opportunities for MDF manufacturers. Countries like South Africa and the UAE are leading the market, with a growing number of local and international players entering the scene. The competitive landscape is evolving, with companies focusing on innovation and quality to meet the diverse needs of consumers. As the region continues to develop, the MDF market is expected to expand, driven by both domestic and international demand.