Advancements in Research and Development

Ongoing advancements in research and development are playing a crucial role in shaping The Global Medical Ceramics Industry. Researchers are exploring new materials and composites that enhance the properties of ceramics, such as strength, durability, and biocompatibility. This focus on innovation is likely to lead to the introduction of next-generation medical ceramics that can better meet the demands of various applications, including dental and orthopedic implants. Furthermore, collaborations between academic institutions and industry players are fostering a culture of innovation, which may result in the commercialization of novel ceramic products. As the market continues to evolve, the potential for breakthroughs in medical ceramics could significantly impact the overall growth trajectory of the industry.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases, such as diabetes and cardiovascular disorders, is likely to drive the demand for medical ceramics in various applications, including orthopedic and dental implants. The Global Medical Ceramics Industry is experiencing a surge in demand for biocompatible materials that can withstand the physiological environment while promoting healing. According to recent estimates, the orthopedic ceramics segment is expected to account for a significant share of the market, driven by the increasing number of joint replacement surgeries. This trend suggests that as the global population ages, the need for durable and effective medical ceramics will continue to grow, thereby enhancing the overall market landscape.

Technological Innovations in Medical Ceramics

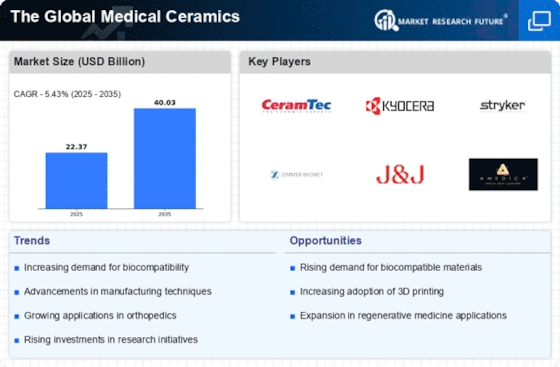

The emergence of advanced manufacturing techniques, such as additive manufacturing and precision machining, appears to be a pivotal driver in The Global Medical Ceramics Industry. These innovations facilitate the production of complex geometries and customized implants, enhancing the performance and integration of ceramic materials in medical applications. For instance, the ability to create patient-specific implants has been linked to improved surgical outcomes and patient satisfaction. Furthermore, the market for advanced ceramics is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years, indicating a robust demand for these technologies. As manufacturers continue to invest in research and development, the potential for new applications and improved product performance in The Global Medical Ceramics Industry remains substantial.

Growing Focus on Minimally Invasive Procedures

The shift towards minimally invasive surgical techniques is reshaping the landscape of The Global Medical Ceramics Industry. As healthcare providers seek to reduce patient recovery times and improve surgical outcomes, the demand for advanced ceramic materials that can be utilized in less invasive procedures is increasing. Medical ceramics, known for their strength and biocompatibility, are being integrated into various surgical tools and implants. This trend is supported by the increasing number of procedures performed globally, with minimally invasive surgeries projected to grow at a rate of 8% annually. Consequently, The Global Medical Ceramics Industry is likely to benefit from this paradigm shift, as manufacturers adapt their offerings to meet the evolving needs of healthcare professionals.

Rising Investment in Healthcare Infrastructure

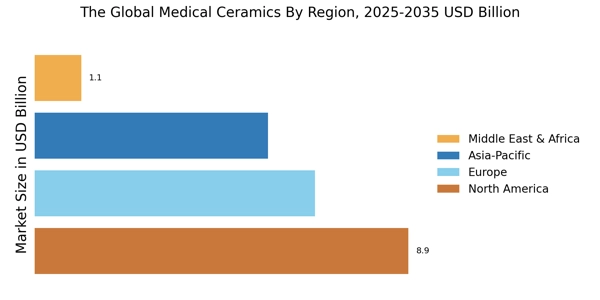

The expansion of healthcare infrastructure in emerging economies is anticipated to bolster The Global Medical Ceramics Industry. Governments and private entities are increasingly investing in healthcare facilities, which is likely to enhance access to advanced medical technologies, including ceramics. This investment trend is particularly evident in regions experiencing rapid urbanization and population growth, where the demand for quality healthcare services is escalating. As a result, the market for medical ceramics is expected to witness significant growth, with projections indicating a potential increase in market size by over 10% in the next five years. This influx of capital into healthcare infrastructure may lead to greater adoption of innovative medical ceramics, thereby transforming the industry landscape.