Expansion of Application Areas

The expansion of application areas is a critical driver for the Optical Ceramics Market. Optical ceramics are increasingly being utilized in various fields, including telecommunications, automotive, and medical imaging. The versatility of these materials allows for their integration into a wide range of products, from laser systems to optical sensors. As industries continue to explore new uses for optical ceramics, the market is expected to experience significant growth. For instance, the automotive sector's shift towards advanced driver-assistance systems (ADAS) is likely to create new opportunities for optical ceramics, further diversifying the market landscape.

Increasing Focus on Energy Efficiency

The Optical Ceramics Market is benefiting from an increasing focus on energy efficiency across various sectors. As industries strive to reduce their carbon footprint, the demand for energy-efficient optical components is on the rise. Optical ceramics, known for their superior thermal stability and low energy consumption, are becoming a preferred choice for applications in lighting, displays, and solar energy systems. This trend is expected to drive the market as manufacturers seek to develop products that align with sustainability goals. The integration of energy-efficient optical ceramics into consumer products is likely to enhance their appeal, thereby fostering market growth.

Innovations in Manufacturing Techniques

Innovations in manufacturing techniques are significantly influencing the Optical Ceramics Market. The introduction of advanced fabrication methods, such as additive manufacturing and precision molding, is enhancing the production efficiency and quality of optical ceramics. These innovations allow for the creation of complex geometries and customized solutions that meet specific application requirements. As a result, manufacturers are better equipped to cater to the diverse needs of various sectors, including aerospace and medical devices. The ability to produce high-quality optical ceramics at a lower cost is expected to attract new players into the market, further stimulating growth and competition.

Rising Demand for High-Performance Optics

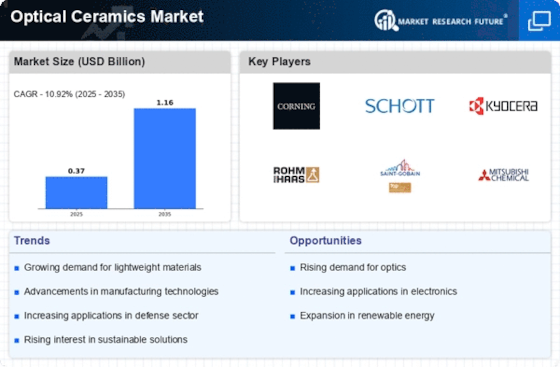

The Optical Ceramics Market is experiencing a notable increase in demand for high-performance optical components. This surge is primarily driven by advancements in sectors such as telecommunications, defense, and consumer electronics. For instance, the need for superior optical materials that can withstand extreme conditions is becoming more pronounced. The market for optical ceramics is projected to grow at a compound annual growth rate of approximately 8% over the next five years, indicating a robust expansion. As industries seek to enhance the performance of optical systems, the demand for durable and efficient optical ceramics is likely to rise, thereby propelling the market forward.

Growing Investment in Research and Development

The Optical Ceramics Market is witnessing a surge in investment directed towards research and development activities. This trend is largely fueled by the increasing need for innovative optical materials that can meet the evolving demands of high-tech applications. Companies are allocating substantial resources to explore new compositions and processing techniques that enhance the performance of optical ceramics. For example, investments in nanotechnology and advanced coatings are expected to yield materials with superior optical properties. This focus on R&D is likely to result in the introduction of groundbreaking products, thereby expanding the market and attracting a wider customer base.