Sustainability and Eco-Friendly Practices

Sustainability initiatives are becoming increasingly pivotal within the Glass Ceramics Market. Manufacturers are focusing on eco-friendly production processes that minimize waste and reduce energy consumption. The shift towards sustainable materials, such as recycled glass, is gaining traction, as consumers and industries alike prioritize environmentally responsible products. This trend is further supported by regulatory frameworks that encourage the use of sustainable materials in construction and consumer goods. As a result, the market is likely to witness a significant increase in demand for sustainable glass ceramics, potentially leading to a market valuation exceeding USD 5 billion by 2030.

Technological Innovations in Glass Ceramics

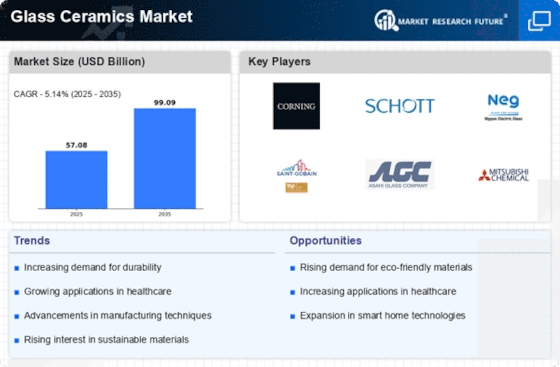

The Glass Ceramics Market is experiencing a surge in technological innovations that enhance product performance and functionality. Advanced manufacturing techniques, such as precision molding and controlled crystallization, are being adopted to produce high-quality glass ceramics. These innovations not only improve the mechanical properties of the materials but also expand their applications in various sectors, including electronics and healthcare. For instance, the introduction of bioactive glass ceramics has revolutionized the dental and orthopedic fields, providing solutions that promote bone regeneration. As a result, the market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these technological advancements.

Expanding Applications in Diverse Industries

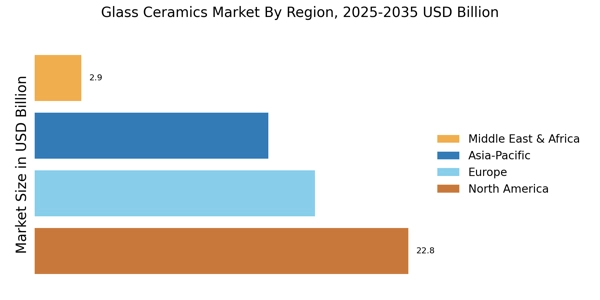

The Glass Ceramics Market is witnessing an expansion in applications across various sectors, including automotive, aerospace, and consumer electronics. The unique properties of glass ceramics, such as high thermal resistance and durability, make them suitable for a wide range of uses. For example, in the automotive sector, glass ceramics are increasingly utilized in engine components and thermal barriers, enhancing vehicle performance and efficiency. Additionally, the electronics industry is adopting glass ceramics for components like insulators and substrates, which are essential for modern electronic devices. This diversification of applications is expected to drive market growth, with projections indicating a potential increase in market size by over 20% in the next five years.

Rising Demand for High-Performance Materials

The demand for high-performance materials is a significant driver in the Glass Ceramics Market. Industries are increasingly seeking materials that can withstand extreme conditions, such as high temperatures and corrosive environments. Glass ceramics, known for their exceptional mechanical and thermal properties, are becoming the material of choice in applications that require durability and reliability. This trend is particularly evident in sectors like aerospace and energy, where the need for advanced materials is critical. As industries continue to prioritize performance and safety, the market for glass ceramics is anticipated to grow, with estimates suggesting a market expansion of approximately 15% over the next few years.

Increased Investment in Research and Development

Investment in research and development is a crucial factor propelling the Glass Ceramics Market forward. Companies are allocating substantial resources to innovate and develop new glass ceramic products that meet evolving consumer demands and industry standards. This focus on R&D is leading to the discovery of novel applications and improved formulations, which enhance the overall performance of glass ceramics. Furthermore, collaborations between academic institutions and industry players are fostering innovation, resulting in breakthroughs that could redefine the market landscape. As a consequence, the Glass Ceramics Market is likely to experience robust growth, with R&D investments projected to increase by 10% annually over the next five years.