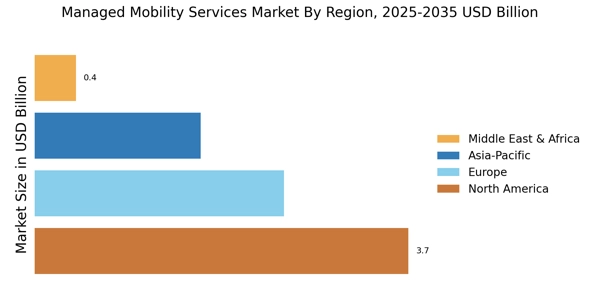

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Managed Mobility Services Market accounted for ~60% market share in 2022 and is expected to exhibit a significant CAGR growth during the study period. This high revenue share is primarily due to the extensive adoption of Bring Your Own Device (BYOD) trend across organizations in the region, which aims to streamline work processes by utilizing mobility and promoting employee collaboration.

Moreover, the widespread usage of mobile devices like smartphones and tablets to aid business continuity, coupled with the critical need to secure sensitive data accessed by employees via their devices, has significantly fueled the adoption of MMS in North America.

Further, the region has demonstrated a willingness to implement MMS within companies to safeguard their sensitive content from privacy breaches and loss while leveraging mobility to gain a competitive edge and offer agile services to customers. Major growth drivers for this region include strict compliance regulations like HIPPA for healthcare and PCI DSS for financial services and extensive cloud deployments. As a result, North America, particularly the U.S., and Canada, is expected to widely implement MMS to ensure data security and privacy, thereby facilitating business continuity.

Figure 3: MANAGED MOBILITY SERVICES MARKET SIZE BY REGION 2022 & 2030

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

European Managed Mobility Services Market accounts for the second-largest market share. Europe is experiencing progressive growth in the adoption of Mobile Device Management Systems (MMS). The increased number of mobile users accessing business data across the region has resulted in concerns regarding data security and privacy breaches. The widespread adoption of cloud technology, facilitated by easy access to data on corporate networks through employees' mobile devices, has provided organizations with significant leverage. However, it has also made data vulnerable to loss and mismanagement due to the diverse operating systems of mobile devices.

As a result, businesses are significantly adopting MMS to address these concerns.

Additionally, small and medium-sized enterprises that allow businesses outside their organizations must adhere to the European Union's Data Protection Directive, which prohibits European companies from transmitting data overseas to countries with weak data protection and privacy laws.

Organizations in the UK, Germany, and France, such as PHS Group Plc., are investing in MMS to prevent privacy breaches and enhance enterprise mobility.

The Asia-Pacific Managed Mobility Services Market is expected to grow at the fastest CAGR between 2022 and 2030, owing to the rising adoption of mobile devices. Enterprises and small and medium-sized businesses in Asia-Pacific countries recognize the importance of data security. They are open to adopting dedicated MMS to enhance organizational productivity through secure mobility. The increasing advancements in mobility and cloud adoption in the region and mandatory compliance with government regulations to resolve data security issues have further fueled the adoption of MMS.

As a result, leading MMS vendors, such as IBM, are expanding their presence in APAC to tap into the enormous demand for mobility services and improve profitability.

Developed countries in Asia-Pacific, such as Japan, Australia, and Singapore, have adopted MMS that comply with data transfer regulations to cater to businesses' unparalleled data security needs. In populous countries like India and China, the adoption of superior MMS is slowly gaining momentum.

However, the need for more awareness about enterprise mobility among businesses in this region has limited the adoption of mobility solutions. Large enterprises may also need more control over their resources, such as mobile devices, after adopting an MMS solution, which inhibits adoption. Nevertheless, the presence of a large number of SMEs in the region augments the consideration of MMS for diverse needs, as they have budget constraints to manage their solutions. This region's MMS market is also expected to be fragmented due to diverse organizational needs.