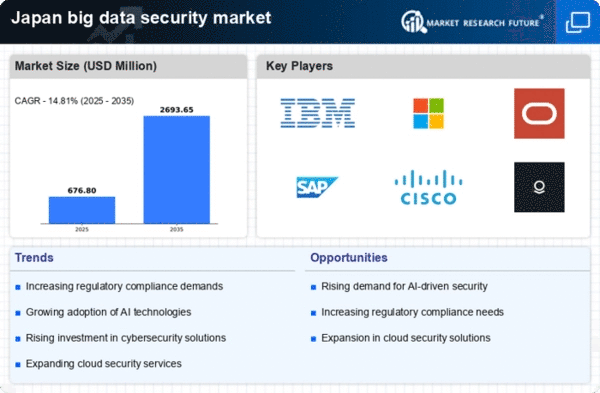

Rising Cyber Threats

The increasing frequency and sophistication of cyber threats in Japan is a primary driver for the big data-security market. As organizations face a growing number of data breaches and cyberattacks, the demand for robust security solutions intensifies. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, with Japan being a significant contributor to this figure. Consequently, businesses are compelled to invest in advanced security measures to protect sensitive data. This trend is likely to propel the growth of the big data-security market, as companies seek to safeguard their information assets against evolving threats.

Increased Data Generation

The exponential growth of data generation in Japan is a crucial factor influencing the big data-security market. With the rise of IoT devices, social media, and digital transactions, organizations are collecting vast amounts of data. According to estimates, the data generated in Japan is projected to reach 50 zettabytes by 2025. This surge in data volume necessitates enhanced security measures to protect sensitive information from unauthorized access and breaches. Consequently, businesses are increasingly investing in big data-security solutions to manage and secure their data effectively, thereby driving market growth.

Evolving Regulatory Landscape

The evolving regulatory landscape in Japan is a significant driver for the big data-security market. With the introduction of stringent data protection laws, organizations are compelled to comply with regulations that mandate the safeguarding of personal and sensitive information. The Personal Information Protection Act (PIPA) has set high standards for data security, leading to increased investments in security technologies. As companies strive to meet compliance requirements, the demand for big data-security solutions is expected to rise. This regulatory pressure is likely to shape the market dynamics, pushing organizations to prioritize data security.

Growing Awareness of Data Privacy

There is a growing awareness of data privacy among consumers and businesses in Japan, which is influencing the big data-security market. As individuals become more conscious of their data rights and the potential risks associated with data breaches, organizations are under pressure to enhance their security measures. This shift in consumer expectations is prompting businesses to adopt comprehensive data protection strategies. In response, the big data-security market is likely to expand as companies invest in solutions that not only protect data but also build trust with their customers.

Government Initiatives and Support

The Japanese government has been actively promoting initiatives aimed at enhancing cybersecurity across various sectors. With the implementation of policies that encourage investment in security technologies, the big data-security market is expected to benefit significantly. For instance, the government has allocated substantial funding to support research and development in cybersecurity solutions. This proactive approach not only fosters innovation but also creates a favorable environment for businesses to adopt advanced security measures. As a result, the big data-security market is likely to experience accelerated growth, driven by government support and initiatives.