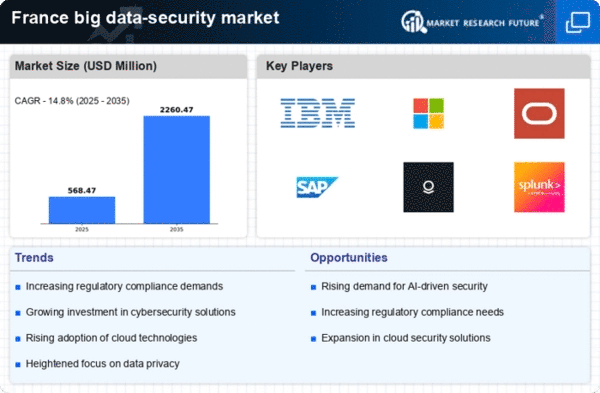

Increased Cloud Adoption

The rapid adoption of cloud computing in France is reshaping the big data-security market. As organizations migrate their operations to the cloud, they face new security challenges that necessitate robust data protection strategies. The cloud environment, while offering scalability and flexibility, also introduces vulnerabilities that can be exploited by cybercriminals. Recent studies indicate that approximately 70% of French companies have adopted cloud services, leading to a heightened focus on securing cloud-based data. This shift is driving demand for advanced security solutions tailored to protect data in cloud environments. Consequently, the big data-security market is witnessing a surge in innovative offerings designed to address the unique security needs associated with cloud computing.

Growing Regulatory Landscape

the evolving regulatory landscape in France influences the big data-security market.. With the implementation of stringent data protection laws, such as the General Data Protection Regulation (GDPR), organizations are compelled to enhance their security frameworks. Compliance with these regulations is not merely a legal obligation but also a strategic necessity to avoid hefty fines, which can reach up to €20 million or 4% of annual global turnover. As businesses navigate this complex regulatory environment, they are increasingly investing in comprehensive data security solutions to ensure compliance and protect consumer data. This trend is expected to drive growth in the big data-security market, as organizations seek to align their practices with regulatory requirements while fostering a culture of data protection.

Demand for Data Privacy Solutions

the growing emphasis on data privacy in France significantly drives the big data-security market.. As consumers become more aware of their data rights and the implications of data misuse, organizations are under pressure to implement robust privacy measures. This shift in consumer expectations is prompting businesses to invest in solutions that not only secure data but also ensure compliance with privacy regulations. The demand for data privacy solutions is reflected in market trends, with a projected growth rate of 15% annually in this segment. Companies are increasingly adopting technologies that facilitate data encryption, access controls, and user consent management. This focus on data privacy is likely to propel the big data-security market forward, as organizations strive to build trust and transparency with their customers.

Emergence of Advanced Technologies

the emergence of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), transforms the big data-security market in France.. These technologies enable organizations to enhance their security posture by automating threat detection and response processes. AI-driven security solutions can analyze vast amounts of data in real-time, identifying anomalies and potential threats with greater accuracy. As businesses increasingly recognize the value of these technologies, investments in AI and ML for data security are on the rise. Reports suggest that the integration of AI in security solutions could reduce incident response times by up to 50%. This trend indicates a shift towards proactive security measures, positioning the big data-security market for substantial growth as organizations seek to leverage technology to combat evolving cyber threats.

Rising Data Breaches and Cyber Threats

The increasing frequency of data breaches and cyber threats in France has become a critical driver for the big data-security market. In recent years, organizations have reported a surge in cyberattacks, with a notable rise in ransomware incidents. This alarming trend has prompted businesses to invest heavily in advanced security solutions to protect sensitive data. According to recent statistics, the cost of data breaches in France has escalated, with average losses reaching €3.5 million per incident. Consequently, The urgency to fortify data security measures is evident. Companies strive to safeguard their assets and maintain customer trust.. The big data-security market is experiencing heightened demand for innovative solutions. These solutions can effectively mitigate risks and ensure compliance with evolving security standards..