Surge in Cyber Threats

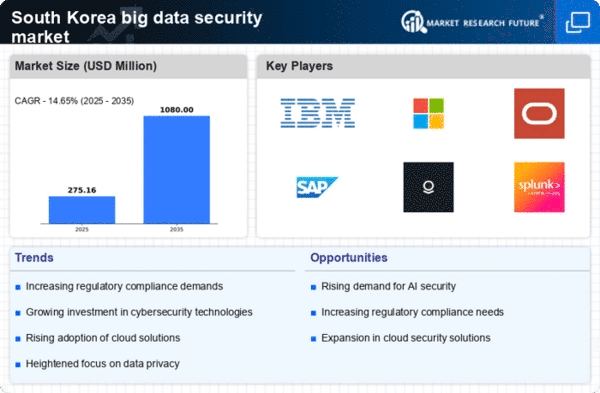

The escalating frequency and sophistication of cyber threats in South Korea have become a pivotal driver for the big data-security market. With incidents of data breaches and ransomware attacks on the rise, organizations are compelled to invest in robust security measures. According to recent statistics, the number of reported cyber incidents has surged by over 30% in the past year alone. This alarming trend underscores the necessity for advanced security solutions that can protect sensitive data from unauthorized access. As businesses increasingly rely on data-driven decision-making, the demand for comprehensive security frameworks that can safeguard vast amounts of information is likely to grow. Consequently, the big data-security market is expected to expand significantly as companies prioritize the protection of their digital assets against evolving cyber threats.

Rising Consumer Awareness

Consumer awareness regarding data privacy and security is on the rise in South Korea, significantly impacting the big data-security market. As individuals become more informed about their rights and the potential risks associated with data misuse, they are demanding greater transparency and accountability from organizations. This heightened awareness is prompting businesses to adopt more stringent security measures to protect customer data and maintain trust. Surveys indicate that over 70% of consumers are concerned about how their data is being used, which is driving companies to prioritize data security initiatives. Consequently, the big data-security market is likely to expand as organizations strive to meet consumer expectations and comply with evolving privacy regulations.

Emergence of Advanced Analytics

The emergence of advanced analytics technologies is reshaping the landscape of the big data-security market in South Korea. Organizations are leveraging analytics to gain insights into potential security threats and vulnerabilities, enabling proactive measures to mitigate risks. The integration of predictive analytics and machine learning algorithms allows for real-time monitoring and threat detection, which is becoming increasingly essential in today’s data-driven environment. As businesses recognize the value of data analytics in enhancing security postures, investments in these technologies are expected to rise. This shift indicates that the big data-security market will likely experience growth as organizations seek to harness the power of analytics to bolster their security frameworks and respond effectively to emerging threats.

Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices in South Korea is driving the demand for enhanced security solutions within the big data-security market. As more devices become interconnected, the volume of data generated increases exponentially, creating new vulnerabilities. Reports indicate that the number of IoT devices in South Korea is projected to reach 1 billion by 2026, which raises concerns about data privacy and security. Organizations are recognizing the need for specialized security measures to protect the data flowing from these devices. This trend suggests that the big data-security market will likely see a surge in demand for solutions tailored to secure IoT ecosystems, ensuring that data integrity and confidentiality are maintained amidst the growing complexity of connected devices.

Increased Investment in Data Protection

In South Korea, there is a marked increase in investment directed towards data protection initiatives, which serves as a significant driver for the big data-security market. Companies are allocating substantial budgets to enhance their security infrastructure, with expenditures on data protection solutions expected to rise by approximately 25% over the next few years. This trend is fueled by the recognition of data as a critical asset and the potential financial repercussions of data breaches. Organizations are increasingly adopting comprehensive security strategies that encompass encryption, access controls, and monitoring systems. As a result, the big data-security market is poised for growth as businesses seek to fortify their defenses against potential threats and comply with stringent data protection regulations.