Rising Cyber Threats

The increasing frequency and sophistication of cyber threats is a primary driver for the big data-security market in Germany. Organizations are facing a surge in data breaches, ransomware attacks, and other malicious activities that compromise sensitive information. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting German companies to invest heavily in security measures. This trend indicates a growing recognition of the need for robust data protection strategies. As businesses strive to safeguard their assets, the demand for advanced security solutions is likely to escalate, thereby propelling the growth of the big data-security market. The urgency to protect customer data and maintain trust further emphasizes the importance of investing in comprehensive security frameworks.

Shift Towards Remote Work

The shift towards remote work has created new challenges for data security in Germany, thereby impacting the big data-security market. As organizations adapt to flexible work arrangements, the need to secure remote access to sensitive data has become paramount. In 2025, it is estimated that remote work will account for 40% of the workforce, necessitating robust security measures to protect data accessed outside traditional office environments. This trend is likely to drive demand for solutions such as VPNs, endpoint security, and secure access controls. Consequently, the big data-security market is expected to grow as companies seek to implement comprehensive security strategies that address the unique risks associated with remote work.

Technological Advancements

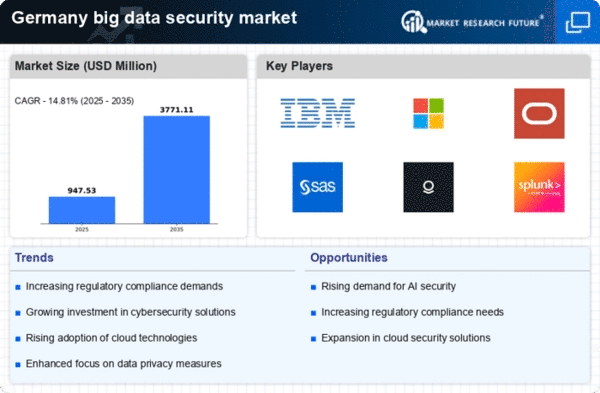

Rapid advancements in technology are significantly influencing the big data-security market in Germany. Innovations in cloud computing, IoT, and big data analytics are creating new opportunities and challenges for data security. As organizations increasingly adopt these technologies, they generate vast amounts of data that require effective protection. In 2025, the market for big data security solutions is projected to reach €20 billion, driven by the need for sophisticated tools that can manage and secure large datasets. The integration of machine learning and AI into security protocols is also enhancing threat detection and response capabilities. Consequently, the big data-security market is expected to expand as companies seek to leverage these technological advancements while ensuring the integrity and confidentiality of their data.

Growing Awareness of Data Governance

There is a notable increase in awareness regarding data governance among organizations in Germany, which is driving the big data-security market. Companies are recognizing the importance of establishing clear policies and procedures for data management, particularly in light of stringent regulations. In 2025, it is anticipated that investments in data governance frameworks will rise by 30%, reflecting a commitment to compliance and risk management. This heightened focus on governance is likely to lead to greater demand for security solutions that facilitate data classification, access control, and audit trails. As organizations strive to enhance their data governance practices, the big data-security market will benefit from the need for comprehensive security measures that align with governance objectives.

Increased Investment in IT Infrastructure

The ongoing investment in IT infrastructure across various sectors in Germany is a significant driver for the big data-security market. Organizations are modernizing their IT systems to support digital transformation initiatives, which often involve the handling of large volumes of data. In 2025, it is projected that IT spending in Germany will exceed €100 billion, with a substantial portion allocated to security solutions. This investment trend indicates a proactive approach to mitigating risks associated with data breaches and cyber threats. As companies enhance their infrastructure, the demand for integrated security solutions that can protect data at every stage of its lifecycle is likely to grow, thereby fueling the expansion of the big data-security market.