Expansion of Smart City Initiatives

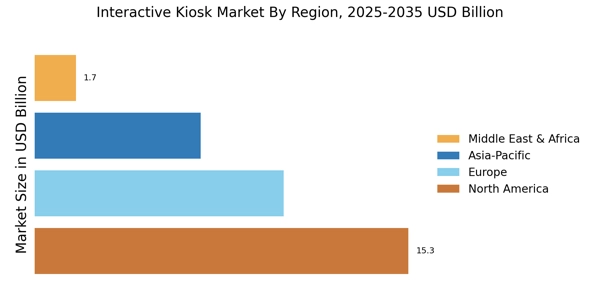

The Interactive Kiosk Market is being positively influenced by the expansion of smart city initiatives across various regions. Governments and municipalities are increasingly investing in technology to improve urban infrastructure and enhance citizen engagement. Interactive kiosks serve as vital components in these initiatives, providing information, services, and connectivity to residents and visitors. For instance, cities are deploying kiosks for wayfinding, public transportation information, and local services. This trend is supported by the growing emphasis on digital transformation in urban planning, with investments in smart city projects projected to exceed 2 trillion USD by 2025. As cities evolve into smart ecosystems, the demand for interactive kiosks is likely to rise, further propelling the Interactive Kiosk Market.

Growing Adoption of Digital Signage

The Interactive Kiosk Market is experiencing a notable increase in the adoption of digital signage solutions. Businesses are increasingly utilizing kiosks to enhance customer engagement through visually appealing displays. This trend is driven by the need for effective communication in retail, hospitality, and transportation sectors. According to recent data, the digital signage market is projected to reach a value of approximately 32 billion USD by 2026, indicating a robust growth trajectory. As organizations seek to modernize their customer interaction strategies, the integration of interactive kiosks with digital signage is likely to become a standard practice. This shift not only improves customer experience but also provides businesses with valuable analytics on consumer behavior, thereby driving further investment in the Interactive Kiosk Market.

Increased Focus on Customer Experience

The Interactive Kiosk Market is significantly driven by an increased focus on enhancing customer experience across various sectors. Businesses are recognizing the importance of providing seamless and engaging interactions to retain customers and foster loyalty. Interactive kiosks are being deployed to streamline processes such as check-ins, ordering, and information retrieval, thereby reducing wait times and improving service efficiency. Research indicates that companies prioritizing customer experience are likely to achieve revenue growth of 4-8% above their market competitors. This growing emphasis on customer-centric strategies is expected to fuel the demand for interactive kiosks, as organizations seek innovative solutions to elevate the customer journey within the Interactive Kiosk Market.

Integration of Artificial Intelligence

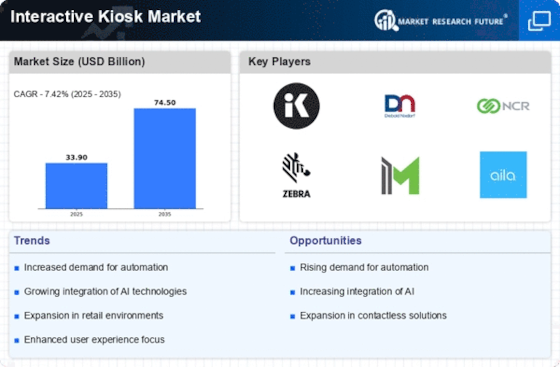

The integration of artificial intelligence (AI) technologies is emerging as a key driver in the Interactive Kiosk Market. AI enhances the functionality of kiosks by enabling personalized interactions, predictive analytics, and improved customer service. For instance, AI-powered kiosks can analyze user behavior and preferences, offering tailored recommendations and solutions. This capability is particularly valuable in retail and hospitality sectors, where personalized experiences can significantly impact customer satisfaction. The AI market is projected to grow to 190 billion USD by 2025, suggesting a strong potential for its application in interactive kiosks. As businesses increasingly adopt AI technologies, the Interactive Kiosk Market is likely to witness substantial growth, driven by the demand for smarter, more responsive customer engagement solutions.

Rising Demand for Contactless Solutions

In the current landscape, the Interactive Kiosk Market is witnessing a surge in demand for contactless solutions. As consumers increasingly prioritize health and safety, businesses are responding by implementing kiosks that facilitate touchless interactions. This trend is particularly evident in sectors such as food service, retail, and healthcare, where minimizing physical contact is essential. Data suggests that the contactless payment market is expected to grow significantly, potentially reaching 6 trillion USD by 2024. This growth is likely to propel the adoption of interactive kiosks equipped with contactless technology, thereby enhancing customer convenience and safety. Consequently, the Interactive Kiosk Market is poised to benefit from this shift towards contactless solutions, as businesses strive to meet evolving consumer expectations.