Rising Adoption of Cloud Services

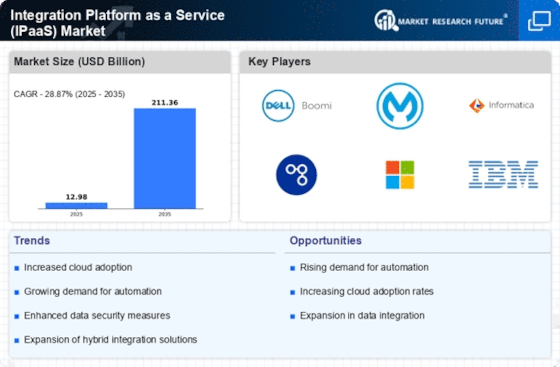

The increasing adoption of cloud services is a pivotal driver for the Integration Platform as a Service Market (IPaaS) Market. Organizations are migrating their operations to the cloud to enhance scalability, flexibility, and cost-effectiveness. According to recent data, the cloud services market is projected to reach a valuation of over 800 billion dollars by 2025. This shift necessitates robust integration solutions to connect various cloud applications and on-premises systems seamlessly. As businesses seek to optimize their cloud environments, the demand for IPaaS solutions is likely to surge, enabling them to manage data flows and application interactions efficiently. Consequently, the Integration Platform as a Service Market (IPaaS) Market is expected to experience substantial growth as enterprises prioritize cloud integration strategies.

Need for Enhanced Operational Efficiency

The quest for enhanced operational efficiency is driving the Integration Platform as a Service Market (IPaaS) Market. Organizations are increasingly recognizing the importance of streamlining their processes to reduce costs and improve productivity. By leveraging IPaaS solutions, businesses can automate workflows, integrate disparate systems, and facilitate real-time data sharing. This integration not only minimizes manual intervention but also accelerates decision-making processes. Recent studies indicate that companies utilizing IPaaS can achieve up to a 30% reduction in operational costs. As organizations strive to remain competitive in a rapidly evolving market, the demand for IPaaS solutions that promote operational efficiency is likely to grow, further propelling the Integration Platform as a Service Market (IPaaS) Market.

Shift Towards Agile Development Practices

The shift towards agile development practices is emerging as a crucial driver for the Integration Platform as a Service Market (IPaaS) Market. Organizations are increasingly adopting agile methodologies to enhance their software development processes, allowing for faster delivery and improved responsiveness to market changes. IPaaS solutions support agile development by enabling rapid integration of applications and services, thereby facilitating continuous delivery and deployment. As businesses strive to innovate and adapt quickly, the demand for IPaaS solutions that align with agile practices is expected to rise. This trend is likely to contribute to the overall growth of the Integration Platform as a Service Market (IPaaS) Market, as organizations seek to leverage integration capabilities to enhance their agile development efforts.

Growing Emphasis on Data Security and Compliance

The growing emphasis on data security and compliance is a significant driver for the Integration Platform as a Service Market (IPaaS) Market. With increasing regulatory requirements and the rising threat of cyberattacks, organizations are prioritizing secure integration solutions. IPaaS providers are responding by implementing advanced security measures, such as encryption and access controls, to protect sensitive data during integration processes. Furthermore, compliance with regulations like GDPR and HIPAA is becoming essential for businesses operating in various sectors. As organizations seek to ensure data integrity and compliance, the demand for secure IPaaS solutions is expected to rise, thereby influencing the growth trajectory of the Integration Platform as a Service Market (IPaaS) Market.

Expansion of Internet of Things (IoT) Applications

The expansion of Internet of Things (IoT) applications is significantly influencing the Integration Platform as a Service Market (IPaaS) Market. As more devices become interconnected, the need for seamless integration between IoT devices and existing systems is paramount. IPaaS solutions facilitate the integration of diverse IoT applications, enabling organizations to harness the data generated by these devices effectively. The IoT market is projected to grow exponentially, with billions of devices expected to be connected in the coming years. This proliferation of IoT applications necessitates robust integration platforms that can manage the complexity of data flows and interactions. Consequently, the demand for IPaaS solutions is likely to increase, driving growth in the Integration Platform as a Service Market (IPaaS) Market.