Increased Focus on Regulatory Compliance

The integration platform-as-a-service market in Germany is also being shaped by an increased focus on regulatory compliance. With stringent regulations such as the General Data Protection Regulation (GDPR) in place, organizations are compelled to ensure that their data handling practices align with legal requirements. Integration platforms provide essential tools for managing data flows and ensuring compliance with these regulations. Companies that leverage integration solutions can enhance their ability to monitor and control data access, thereby reducing the risk of non-compliance penalties. It is estimated that businesses investing in compliance-focused integration solutions can mitigate potential fines by up to 25%, underscoring the financial implications of regulatory adherence in the integration platform-as-a-service market.

Emergence of Advanced Analytics Capabilities

The integration platform-as-a-service market is witnessing a growing interest in advanced analytics capabilities. These capabilities are becoming increasingly vital for organizations in Germany. As businesses accumulate vast amounts of data, the ability to analyze and derive insights from this data is paramount. Integration platforms facilitate the seamless flow of data to analytics tools, enabling organizations to harness the power of data-driven decision-making. Recent studies indicate that companies utilizing advanced analytics can improve their operational performance by as much as 20%. This trend suggests that the integration platform-as-a-service market will continue to thrive as organizations seek to integrate analytics into their operations, thereby enhancing their competitive edge in an increasingly data-centric landscape.

Growing Demand for Real-Time Data Integration

The integration platform-as-a-service market in Germany is experiencing a notable surge in demand for real-time data solutions. Businesses are increasingly recognizing the necessity of accessing and processing data in real-time to enhance decision-making and operational efficiency. This trend is particularly pronounced in sectors such as finance and retail, where timely data can significantly impact customer satisfaction and competitive advantage. According to recent estimates, the market for real-time data integration solutions is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader shift towards agile business practices, where organizations leverage integration platforms to streamline workflows and improve responsiveness to market changes.

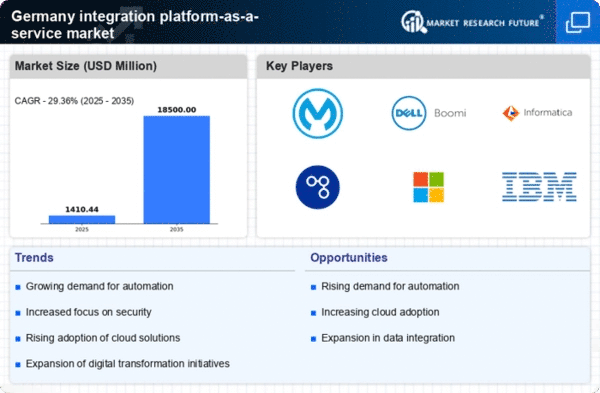

Expansion of Digital Transformation Initiatives

The integration platform-as-a-service market is significantly influenced by the ongoing expansion of digital transformation initiatives. These initiatives are occurring across various sectors in Germany. Organizations are increasingly investing in digital technologies to enhance customer experiences, improve service delivery, and drive innovation. This transformation often necessitates the integration of disparate systems and applications, which is where integration platforms play a pivotal role. As per industry insights, approximately 70% of German companies are currently engaged in some form of digital transformation, creating a robust demand for integration solutions. This trend is expected to propel the integration platform-as-a-service market forward, as businesses seek to create cohesive digital ecosystems that facilitate data sharing and collaboration.

Rising Need for Enhanced Operational Efficiency

In the context of the integration platform-as-a-service market, the pursuit of enhanced operational efficiency is a critical driver for businesses in Germany. Organizations are increasingly adopting integration solutions to automate processes, reduce manual intervention, and minimize errors. This shift is particularly relevant in industries such as manufacturing and logistics, where operational efficiency can lead to substantial cost savings. Reports suggest that companies utilizing integration platforms can achieve up to a 30% reduction in operational costs by streamlining their workflows. As businesses continue to seek ways to optimize their operations, the integration platform-as-a-service market is likely to see sustained growth, driven by the demand for solutions that facilitate seamless connectivity and process automation.