Increased Focus on Operational Agility

In the current business landscape, the emphasis on operational agility is becoming a critical driver for the integration platform-as-a-service market in Europe. Companies are striving to adapt quickly to changing market conditions and customer demands, necessitating flexible and scalable integration solutions. The ability to integrate various applications and data sources efficiently allows organizations to respond to challenges and opportunities with greater speed. As a result, the integration platform-as-a-service market is witnessing a shift towards solutions that offer enhanced agility and responsiveness. This trend is expected to continue, with many organizations prioritizing integration capabilities that support their agile methodologies and operational frameworks.

Regulatory Compliance and Data Governance

The The market in Europe is significantly influenced by the increasing emphasis on regulatory compliance and data governance. With stringent regulations such as the General Data Protection Regulation (GDPR) in place, organizations are compelled to ensure that their data integration practices adhere to legal standards. This necessity drives the demand for integration solutions that not only facilitate data connectivity but also incorporate compliance features. As businesses navigate the complexities of data governance, the integration platform-as-a-service market is likely to see a rise in solutions that offer robust compliance capabilities. This trend indicates a growing awareness among organizations regarding the importance of integrating compliance into their operational frameworks.

Rising Demand for Real-Time Data Integration

The The market in Europe experiences a notable surge in demand for real-time data integration solutions. Organizations increasingly recognize the necessity of accessing and processing data instantaneously to enhance decision-making and operational efficiency. This trend is particularly pronounced in sectors such as finance and retail, where timely insights can lead to competitive advantages. According to recent estimates, the market for real-time data integration is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for businesses to respond swiftly to market changes and customer preferences, thereby propelling the integration platform-as-a-service market forward.

Growing Need for Enhanced Customer Experience

The integration platform-as-a-service market in Europe is increasingly shaped by the growing need for enhanced customer experience. Businesses are recognizing that seamless integration of customer data across various touchpoints is essential for delivering personalized and consistent experiences. As customer expectations evolve, organizations are compelled to adopt integration solutions that enable them to gather, analyze, and utilize customer data effectively. This shift is reflected in the market, where the demand for customer-centric integration platforms is on the rise. It is estimated that companies focusing on customer experience improvements are likely to invest significantly in integration technologies, thereby driving growth in the integration platform-as-a-service market.

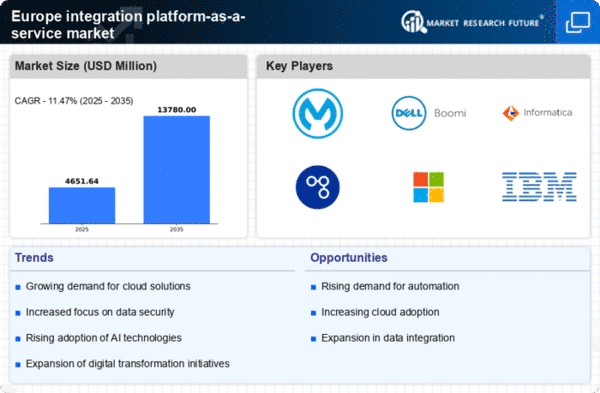

Expansion of Digital Transformation Initiatives

The ongoing digital transformation initiatives across various industries in Europe significantly influence the integration platform-as-a-service market. Organizations are increasingly investing in digital technologies to streamline operations, enhance customer experiences, and improve overall efficiency. As a result, the demand for integration solutions that facilitate seamless connectivity between disparate systems and applications is on the rise. Reports indicate that nearly 70% of European companies are prioritizing digital transformation, which in turn drives the need for robust integration platforms. This trend suggests a strong correlation between digital transformation efforts and the growth of the integration platform-as-a-service market, as businesses seek to leverage technology for strategic advantages.