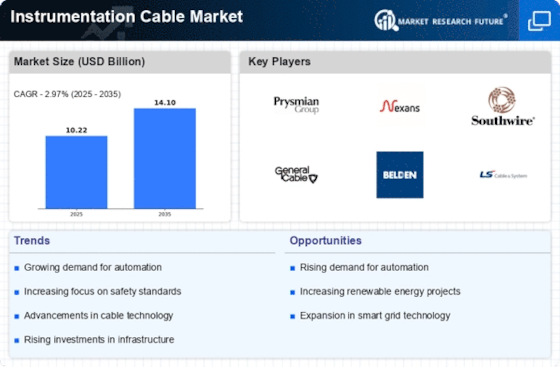

Instrumentation Cable Market Summary

As per Market Research Future analysis, the Instrumentation Cable Market Size was valued at USD 6,330.7 million in 2024. The Instrumentation Cable Industry is projected to grow from USD 6,577.6 million in 2025 to USD 10,007.3 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.3% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Instrumentation Cable Market exhibits dynamic trends shaped by regulatory pressures, technological innovations, and expanding applications across automotive sectors.

- Industrial automation accelerates demand for high-performance cables in process control. Sectors like oil & gas, chemicals, and pharmaceuticals adopt these for real-time monitoring.

- Fiber optic cables lead due to high bandwidth and immunity to electromagnetic interference. They outperform traditional copper in speed and distance for signal transmission, dominating market share amid IoT expansion.

- Twisted pair shielded cables emerge fastest-growing, ideal for noisy industrial settings with enhanced noise rejection. Hybrid designs combining fiber and copper gain traction for versatile applications.

- Rising renewable projects boost specialized cables for solar farms, wind turbines, and smart grids. Power generation end-use sees heightened needs for durable, weather-resistant options amid global energy transitions.

- Industrial Internet of Things (IIoT) drives cables with advanced connectivity for remote analytics. Demand surges for IoT-enabled monitoring in utilities, oil & gas, and aerospace, supporting data-heavy networks.

Market Size & Forecast

| 2024 Market Size | 6,330.7 (USD Million) |

| 2035 Market Size | 10,007.3 (USD Million) |

| CAGR (2025 - 2035) | 4.3% |

Major Players

Belden Inc, Prysmian S.p.A, NEXANS, KEI Industries Limited, Thermo Cables, Tratos, Eland Cables, Top Cable, Allied Wire & Cable, Inc, Bahra Electric, Southwire Company, LLC and LS Cable & System Ltd.