Rising Demand in Telecommunications

The InGaAs Image Sensor Market is witnessing a notable increase in demand from the telecommunications sector. As the need for high-speed data transmission and improved communication systems escalates, InGaAs image sensors are becoming essential components in fiber optic networks. These sensors facilitate high-performance imaging in low-light conditions, which is crucial for applications such as optical coherence tomography and remote sensing. The telecommunications industry is expected to invest heavily in upgrading infrastructure, which could lead to a significant uptick in the adoption of InGaAs image sensors. This trend suggests a robust growth trajectory for the market, as these sensors are integral to enhancing communication technologies.

Expansion in Medical Imaging Applications

The InGaAs Image Sensor Market is increasingly being driven by the expansion of medical imaging applications. InGaAs sensors are particularly well-suited for near-infrared imaging, which is vital for various medical diagnostics and therapeutic procedures. The growing prevalence of chronic diseases and the need for advanced imaging techniques are propelling the demand for these sensors in healthcare settings. Market analysts indicate that the medical imaging segment could account for a substantial share of the InGaAs image sensor market, potentially reaching a valuation of several hundred million dollars by 2026. This growth is indicative of the sensors' critical role in enhancing diagnostic accuracy and patient outcomes.

Growing Interest in Environmental Monitoring

The InGaAs Image Sensor Market is experiencing a growing interest in environmental monitoring applications. These sensors are increasingly utilized in remote sensing technologies to monitor air quality, water quality, and other environmental parameters. The rising awareness of environmental issues and the need for sustainable practices are propelling the demand for accurate and reliable monitoring solutions. As governments and organizations invest in environmental protection initiatives, the adoption of InGaAs image sensors is likely to increase. This trend suggests a promising future for the market, as these sensors play a crucial role in providing data that informs policy decisions and environmental management strategies.

Increased Investment in Research and Development

The InGaAs Image Sensor Market is benefiting from increased investment in research and development activities. Companies are allocating significant resources to innovate and improve sensor technologies, which is likely to yield new products with enhanced features and capabilities. This focus on R&D is essential for maintaining competitive advantage in a rapidly evolving market. Furthermore, collaborations between academic institutions and industry players are fostering the development of cutting-edge applications, which could open new avenues for growth. As a result, the market may see a proliferation of advanced InGaAs image sensors that cater to diverse applications, thereby driving overall market expansion.

Technological Innovations in InGaAs Image Sensors

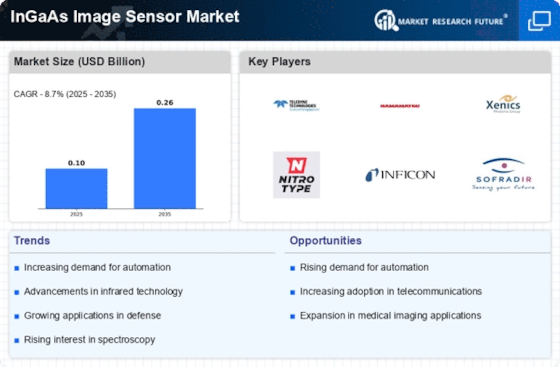

The InGaAs Image Sensor Market is experiencing a surge in technological innovations that enhance sensor performance and capabilities. Recent advancements in semiconductor materials and fabrication techniques have led to improved sensitivity and resolution in imaging applications. For instance, the integration of advanced signal processing algorithms has enabled better noise reduction and image clarity, making these sensors more appealing for various applications. The market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by these innovations. Furthermore, the development of compact and lightweight sensors is likely to expand their use in portable devices, thereby increasing their adoption across multiple sectors.