Technological Advancements

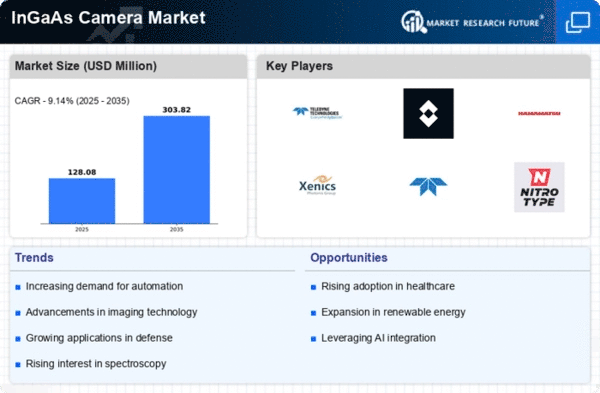

The Global InGaAs Camera Market Industry is experiencing rapid technological advancements, particularly in sensor design and image processing capabilities. These innovations enhance the performance of InGaAs cameras, making them more efficient and versatile for various applications, including industrial inspection and scientific research. For instance, the integration of advanced algorithms allows for improved image quality and faster processing times. As a result, the market is projected to reach 117.0 USD Million in 2024, reflecting the growing demand for high-performance imaging solutions across multiple sectors.

Expansion in Security and Surveillance

The Global InGaAs Camera Market Industry is experiencing expansion in the security and surveillance sector, where InGaAs cameras are utilized for enhanced night vision capabilities. Their performance in low-light conditions makes them ideal for applications in border security, critical infrastructure protection, and urban surveillance. As security concerns continue to escalate globally, the demand for advanced imaging solutions is likely to increase. This trend is expected to drive market growth, as organizations seek reliable technologies to ensure safety and security in various environments.

Rising Adoption in Scientific Research

The Global InGaAs Camera Market Industry is bolstered by the rising adoption of InGaAs cameras in scientific research applications. These cameras are essential for various fields, including spectroscopy and environmental monitoring, where their sensitivity to infrared wavelengths enables researchers to gather critical data. The increasing focus on advanced research methodologies and the need for high-resolution imaging are likely to propel market growth. As research institutions invest in cutting-edge technology, the demand for InGaAs cameras is expected to rise, contributing to a projected CAGR of 9.45% from 2025 to 2035.

Emerging Markets and Increased Investment

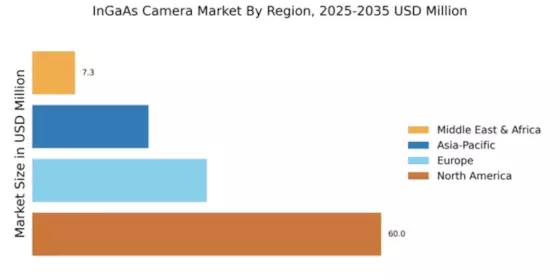

The Global InGaAs Camera Market Industry is benefiting from emerging markets that are increasingly investing in advanced imaging technologies. Countries in Asia-Pacific and Latin America are witnessing a rise in demand for InGaAs cameras across various sectors, including healthcare and agriculture. This trend is driven by the need for improved diagnostic tools and precision farming techniques. As these regions continue to develop economically, the market is poised for growth, with investments in research and development further enhancing the capabilities and applications of InGaAs cameras.

Growing Demand in Industrial Applications

The Global InGaAs Camera Market Industry is witnessing a surge in demand from industrial applications, particularly in sectors such as manufacturing and quality control. InGaAs cameras are increasingly utilized for non-destructive testing and monitoring processes, where their ability to capture images in the shortwave infrared spectrum proves invaluable. This trend is expected to contribute significantly to market growth, with projections indicating a market size of 315.9 USD Million by 2035. The need for precision and reliability in industrial settings drives the adoption of these cameras, further solidifying their role in enhancing operational efficiency.