Expansion of IoT Applications

The proliferation of Internet of Things (IoT) applications is a significant driver for the Industrial Ethernet Switch Market. As more devices become interconnected, the need for reliable and efficient networking solutions becomes increasingly apparent. Industrial Ethernet switches are essential for managing the vast amounts of data generated by IoT devices, ensuring that information flows seamlessly across networks. The IoT market is projected to reach a valuation of over 1 trillion dollars by 2025, which suggests a substantial increase in demand for industrial Ethernet switches to support these applications. This expansion not only highlights the growing reliance on connected devices but also emphasizes the critical role of industrial Ethernet switches in facilitating the communication necessary for IoT ecosystems, thereby driving growth in the Industrial Ethernet Switch Market.

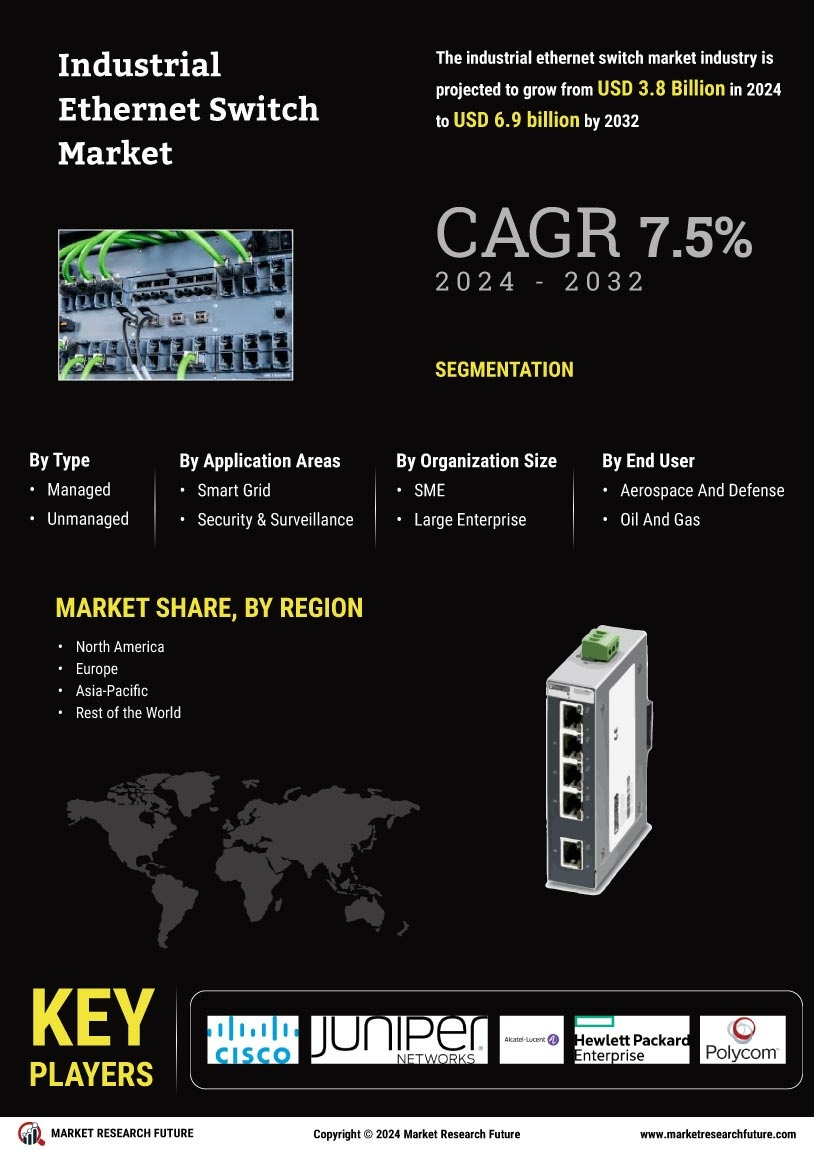

Growth in Smart Grid Initiatives

The growth in smart grid initiatives is significantly influencing the Industrial Ethernet Switch Market. As energy providers transition towards more intelligent and efficient grid systems, the demand for reliable communication networks becomes essential. Industrial Ethernet switches facilitate the integration of various components within smart grids, ensuring that data is transmitted effectively between generation, distribution, and consumption points. The smart grid market is anticipated to witness a compound annual growth rate of around 8% in the upcoming years, which suggests a robust demand for industrial Ethernet switches to support these initiatives. This trend not only highlights the importance of modernizing energy infrastructure but also underscores the critical role of industrial Ethernet switches in enabling the connectivity required for smart grid operations, thereby driving growth in the Industrial Ethernet Switch Market.

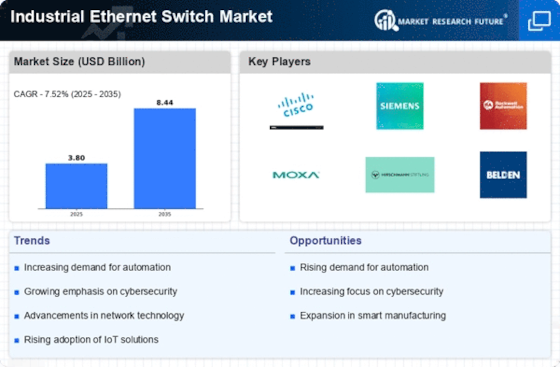

Focus on Enhanced Network Security

As cyber threats continue to evolve, the focus on enhanced network security is becoming a pivotal driver for the Industrial Ethernet Switch Market. Industries are increasingly aware of the vulnerabilities associated with networked systems, prompting investments in secure networking solutions. Industrial Ethernet switches equipped with advanced security features, such as encryption and intrusion detection, are in high demand as organizations seek to protect their critical infrastructure. The market for industrial cybersecurity solutions is expected to grow at a rate of approximately 10% annually, indicating a strong correlation with the Industrial Ethernet Switch Market. This emphasis on security not only addresses the immediate concerns of data breaches but also fosters trust in industrial networks, further propelling the adoption of industrial Ethernet switches.

Increasing Automation in Industries

The Industrial Ethernet Switch Market is experiencing a notable surge due to the increasing automation across various sectors. Industries such as manufacturing, oil and gas, and transportation are adopting automated systems to enhance efficiency and reduce operational costs. This trend is likely to drive the demand for industrial Ethernet switches, which facilitate seamless communication between devices in automated environments. According to recent data, the automation market is projected to grow at a compound annual growth rate of over 9% in the coming years, further propelling the Industrial Ethernet Switch Market. As industries seek to optimize their processes, the reliance on robust networking solutions becomes paramount, indicating a strong correlation between automation trends and the growth of the industrial Ethernet switch sector.

Rising Need for Real-Time Data Processing

In the context of the Industrial Ethernet Switch Market, the rising need for real-time data processing is a critical driver. Industries are increasingly relying on data analytics to make informed decisions, necessitating high-speed and reliable network infrastructure. Industrial Ethernet switches play a vital role in ensuring that data is transmitted swiftly and accurately between devices, enabling timely responses to operational changes. The demand for real-time data processing solutions is expected to grow significantly, with estimates suggesting a market expansion of approximately 12% annually. This trend underscores the importance of industrial Ethernet switches in supporting the infrastructure required for effective data management and operational efficiency, thereby reinforcing their significance in the Industrial Ethernet Switch Market.