Market Share

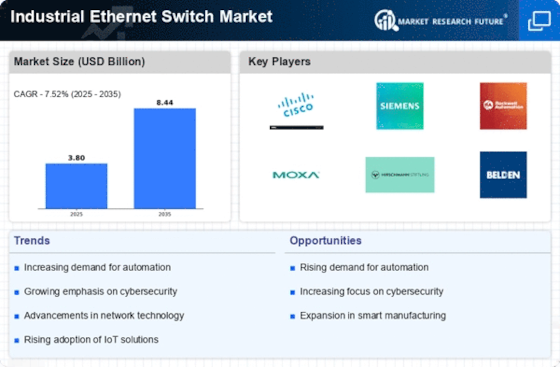

Industrial Ethernet Switch Market Share Analysis

Market participants frequently concentrate on industry-specific customisation to meet the particular needs of certain industries. Using this tactic, Industrial Ethernet Switches are customized to fulfill the unique requirements of sectors including manufacturing, energy, transportation, and healthcare. Features like industry-specific application integration, compatibility for specialist communication protocols, and ruggedized designs for hostile situations are examples of customization. By satisfying the unique requirements of different industries, businesses may seize specialized markets and increase their overall market share. Market share positioning requires both consumer trust and brand repute. Businesses that regularly produce superior Industrial Ethernet switches and offer first-rate customer service tend to establish significant brand equity. Customer loyalty and trust are influenced by favorable evaluations, endorsements, and a track record of dependable products. A company's excellent brand reputation influences consumer decisions and helps it get a larger market share by positioning it as a dependable option. Companies often use geographic expansion as a tactic to increase their market share. Businesses may access a broader range of industrial sectors and expand their client base by forging a strong presence in important international marketplaces. By comprehending and adjusting to regional differences in industrial needs, laws, and tastes, this growth method enables businesses to efficiently service clients in various geographic places. Developing a wide range of products is a calculated move that will increase market share. To meet the various demands of industrial clients, companies frequently provide a variety of Industrial Ethernet Switches with differing features and capabilities. Companies may cater to diverse market segments and guarantee that their solutions are appropriate for a range of industries and applications by maintaining a wide product selection. Market share positioning is also influenced by prompt customer care and after-sale assistance. Client connections are strengthened by businesses who put a high priority on customer satisfaction and offer prompt assistance with installation, troubleshooting, and maintenance. Satisfied customers are more likely to recommend a firm to others and bring in repeat business, which enhances its reputation in the marketplace and leads to a higher market share.

Leave a Comment