Advancements in Network Technology

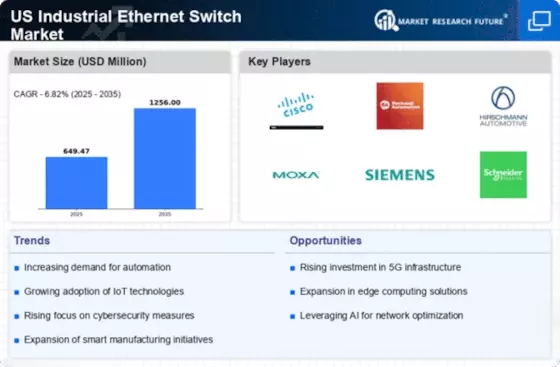

The US Industrial Ethernet Switch Market Industry is benefiting from rapid advancements in network technology. Innovations such as increased bandwidth, lower latency, and enhanced reliability are driving the adoption of industrial Ethernet switches across various sectors. These technological improvements enable industries to support more devices and applications, facilitating the growth of the Industrial Internet of Things (IIoT). As companies seek to leverage IIoT capabilities, the demand for high-performance networking solutions is expected to rise. Furthermore, the integration of technologies like 5G is anticipated to further enhance the capabilities of industrial Ethernet switches, allowing for more robust and flexible network architectures. Consequently, the US Industrial Ethernet Switch Market Industry is positioned for growth as organizations embrace these advancements to optimize their operations.

Expansion of Smart Grid Initiatives

The US Industrial Ethernet Switch Market Industry is significantly influenced by the expansion of smart grid initiatives across the country. As energy providers modernize their infrastructure, the need for reliable and efficient communication networks becomes critical. Industrial Ethernet switches play a vital role in connecting various components of the smart grid, ensuring that data flows seamlessly between generation, transmission, and distribution systems. The US government has been actively promoting smart grid technologies, which is likely to result in increased investments in industrial networking solutions. This shift towards smarter energy management systems not only enhances operational efficiency but also supports sustainability goals. As a result, the US Industrial Ethernet Switch Market Industry is expected to benefit from the growing emphasis on smart grid development.

Rising Focus on Industrial Cybersecurity

In the context of the US Industrial Ethernet Switch Market Industry, the rising focus on industrial cybersecurity is a critical driver. As industries become more interconnected, the potential for cyber threats increases, prompting organizations to invest in secure networking solutions. Industrial Ethernet switches equipped with advanced security features are essential for protecting sensitive data and ensuring the integrity of industrial operations. Recent statistics indicate that cybersecurity spending in the industrial sector is on the rise, with companies prioritizing investments in secure communication technologies. This trend is particularly relevant in sectors such as energy and manufacturing, where the consequences of cyberattacks can be severe. Therefore, the US Industrial Ethernet Switch Market Industry is likely to see growth as businesses seek to enhance their cybersecurity posture through reliable networking solutions.

Growing Demand for Automation in Manufacturing

The US Industrial Ethernet Switch Market Industry is experiencing a notable surge in demand driven by the increasing automation in manufacturing processes. As industries strive for enhanced efficiency and productivity, the integration of automated systems necessitates robust networking solutions. Industrial Ethernet switches facilitate seamless communication between devices, enabling real-time data exchange and operational control. According to recent data, the manufacturing sector in the US is projected to invest heavily in automation technologies, which is likely to propel the demand for industrial Ethernet switches. This trend is particularly evident in sectors such as automotive and electronics, where precision and speed are paramount. Consequently, the US Industrial Ethernet Switch Market Industry is poised for growth as manufacturers seek reliable networking solutions to support their automation initiatives.

Regulatory Support for Industrial Connectivity

The US Industrial Ethernet Switch Market Industry is also influenced by regulatory support aimed at enhancing industrial connectivity. Government initiatives and policies promoting the adoption of advanced manufacturing technologies are likely to drive demand for industrial Ethernet switches. For instance, programs that encourage the modernization of industrial infrastructure often include provisions for upgrading networking capabilities. This regulatory environment fosters investment in reliable communication solutions, as industries seek to comply with new standards and improve operational efficiency. Additionally, the push for increased connectivity in sectors such as transportation and utilities further underscores the importance of industrial Ethernet switches. As a result, the US Industrial Ethernet Switch Market Industry is expected to grow in response to favorable regulatory conditions that support enhanced industrial connectivity.