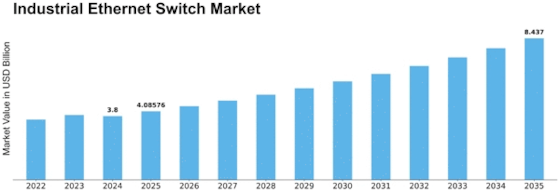

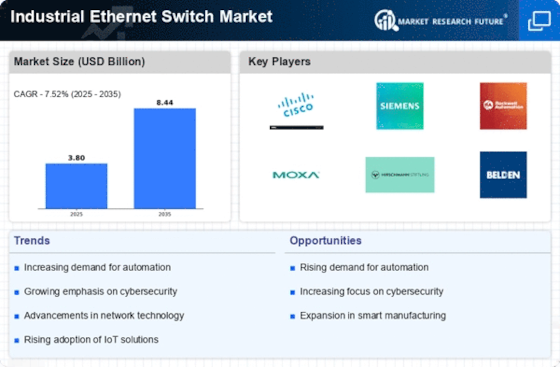

Industrial Ethernet Switch Size

Industrial Ethernet Switch Market Growth Projections and Opportunities

Numerous market dynamics impact the Industrial Ethernet Switch market, which in turn shapes its growth trajectory and landscape. The quick spread of industrial automation across several industries is one of the main motivators. Industrial Ethernet switches are essential for providing the network connectivity required for smooth communication between automated systems. As enterprises seek for greater production and efficiency, the adoption of automation technology becomes essential. Another important element driving the Industrial Ethernet Switch market is the further development of Industry 4.0 principles. The objective of Industry 4.0 is to provide intelligent and networked industrial settings through the integration of smart technologies, IoT devices, and real-time data analytics. These networked systems are supported by industrial Ethernet switches, which allow for the efficient exchange of data and the application of sophisticated automation and control techniques. The market is also being driven by the growing need for dependable and fast communication networks in industrial settings. The data-intensive nature of industrial operations necessitates networks that can analyze massive amounts of data quickly. For industrial operations to satisfy these demands and provide the necessary levels of speed and responsiveness, industrial Ethernet switches—especially those that enable Gigabit and 10 Gigabit speeds—are in great demand. Another aspect driving the Industrial Ethernet Switch market is the focus on cybersecurity in industrial networks. The susceptibility to cyber dangers increases as sectors become increasingly digitalized and interconnected. Industrial Ethernet switches that are equipped with strong security features, such encryption protocols, secure access controls, and network segmentation, are becoming more and more popular as businesses place a higher priority on defending their vital infrastructure from online attacks. The industry is also being impacted by the growing use of Power over Ethernet (PoE) technologies. PoE makes it possible for data and electricity to be transmitted simultaneously over a single Ethernet connection, which makes it easier to install devices like access points, IP cameras, and sensors. Industries looking to simplify installations and improve the effectiveness of power distribution within their buildings are drawn to PoE-enabled Industrial Ethernet Switches because of its adaptability.

Leave a Comment