Focus on Cost Efficiency

Cost efficiency remains a primary driver for the platform as-a-service market in India. Organizations are increasingly looking to reduce operational costs while maintaining high levels of performance and reliability. By leveraging platform as-a-service solutions, businesses can eliminate the need for extensive on-premises infrastructure, thus lowering capital expenditures. This shift is particularly appealing to small and medium enterprises that often operate with limited budgets. Recent studies indicate that companies utilizing platform as-a-service can reduce their IT costs by up to 30%. This focus on cost efficiency is likely to continue driving the adoption of platform as-a-service solutions across various sectors.

Government Initiatives and Support

Government initiatives aimed at promoting digital transformation are playing a crucial role in the growth of the platform as-a-service market in India. Programs such as Digital India and Make in India are encouraging businesses to adopt cloud technologies, thereby fostering innovation and competitiveness. The government is also investing in infrastructure development, which is expected to enhance connectivity and accessibility to cloud services. As a result, the platform as-a-service market is likely to benefit from increased adoption among enterprises looking to leverage these initiatives for their digital strategies. This supportive environment may lead to a projected growth rate of 25% in the coming years.

Rising Demand for Scalable Solutions

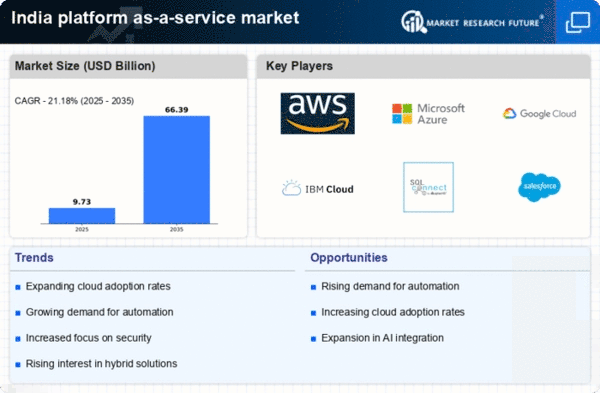

The platform as-a-service market in India is experiencing a notable surge in demand for scalable solutions. Businesses are increasingly seeking flexible platforms that can adapt to their evolving needs. This trend is driven by the rapid growth of startups and SMEs, which require cost-effective and scalable infrastructure to support their operations. According to recent data, the Indian cloud computing market is projected to reach $10 billion by 2025, with a significant portion attributed to platform as-a-service offerings. This demand for scalability is likely to propel the platform as-a-service market forward, as organizations look to optimize their resources and enhance operational efficiency.

Emergence of Industry-Specific Solutions

The emergence of industry-specific solutions is shaping the platform as-a-service market in India. As various sectors, including healthcare, finance, and retail, seek tailored solutions to meet their unique challenges, platform as-a-service providers are responding by developing specialized offerings. This trend is indicative of a broader shift towards customization in cloud services, allowing businesses to leverage the full potential of platform as-a-service technologies. The increasing focus on industry-specific needs is likely to drive innovation and competition within the platform as-a-service market, as providers strive to differentiate their services and capture niche segments.

Growing Need for Rapid Development and Deployment

The platform as-a-service market in India is witnessing a growing need for rapid development and deployment of applications. As businesses strive to remain competitive, the ability to quickly launch new products and services has become paramount. Platform as-a-service solutions provide the necessary tools and environments for developers to streamline the application development process. This trend is particularly evident in sectors such as e-commerce and fintech, where speed to market is critical. The increasing demand for agile development practices is expected to further fuel the growth of the platform as-a-service market, as organizations seek to enhance their responsiveness to market changes.