Focus on Enhancing User Experience

Enhancing user experience (UX) has become a paramount focus for businesses in India, driving growth in the enterprise high-productivity-application-platform-service market. Companies are increasingly aware that a superior UX can lead to higher customer satisfaction and retention rates. As a result, investments in application platforms that prioritize UX design are on the rise. Data suggests that organizations that improve their UX can see conversion rates increase by up to 400%. This emphasis on user-centric design is likely to propel the demand for high-productivity application platforms, as businesses seek solutions that enable them to create intuitive and engaging applications.

Emergence of Cloud Computing Solutions

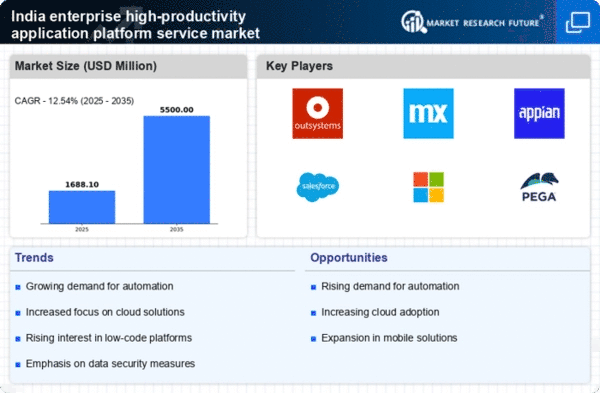

The emergence of cloud computing solutions is significantly influencing the enterprise high-productivity-application-platform-service market in India. As businesses migrate to cloud-based environments, the demand for platforms that facilitate rapid application development in the cloud is increasing. Cloud adoption in India is projected to grow at a CAGR of 30% over the next few years, with many organizations leveraging cloud services to enhance scalability and reduce infrastructure costs. This shift is likely to drive the enterprise high-productivity-application-platform-service market, as companies seek platforms that can seamlessly integrate with cloud environments and support the development of scalable applications.

Growing Demand for Digital Transformation

The enterprise high-productivity-application-platform-service market is experiencing a surge in demand driven by the ongoing digital transformation initiatives across various sectors in India. Organizations are increasingly adopting digital technologies to enhance operational efficiency and improve customer experiences. According to recent data, approximately 70% of Indian enterprises are prioritizing digital transformation, which necessitates the use of high-productivity application platforms. This trend is likely to continue as businesses seek to streamline processes and reduce time-to-market for new applications. The enterprise high-productivity-application-platform-service market is thus positioned to benefit from this growing demand, as companies look for solutions that enable rapid application development and deployment.

Increased Investment in IT Infrastructure

Investment in IT infrastructure is a critical driver for the enterprise high-productivity-application-platform-service market in India. As organizations recognize the importance of robust IT systems, spending on technology infrastructure has seen a notable increase. Reports indicate that IT spending in India is projected to reach $100 billion by 2025, with a significant portion allocated to application development platforms. This investment is essential for supporting the deployment of high-productivity application services, which facilitate faster development cycles and improved collaboration among teams. Consequently, the enterprise high-productivity-application-platform-service market is likely to thrive as businesses enhance their IT capabilities to meet evolving market demands.

Rising Need for Agile Development Practices

The shift towards agile development practices is reshaping the enterprise high-productivity-application-platform-service market in India. Organizations are increasingly adopting agile methodologies to enhance flexibility and responsiveness in application development. This trend is evident as approximately 60% of Indian companies have reported implementing agile practices in their software development processes. High-productivity application platforms are particularly suited to support these agile methodologies, enabling teams to iterate quickly and deliver applications that meet user needs. As the demand for agility in development continues to grow, the enterprise high-productivity-application-platform-service market is expected to expand, providing tools that align with these evolving practices.