Market Growth Projections

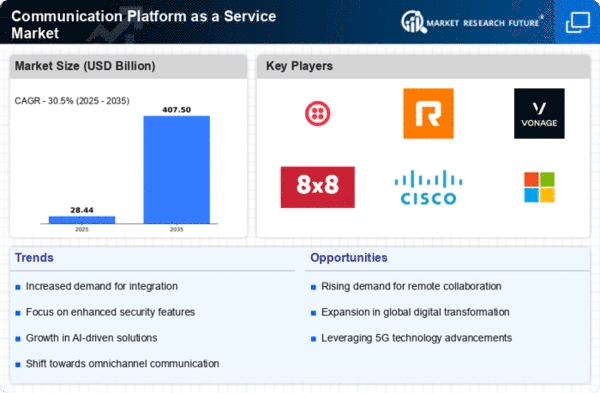

The Global Communication Platform as a Service Market Industry is poised for substantial growth, with projections indicating a rise from 12.8 USD Billion in 2024 to 25 USD Billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 6.3% from 2025 to 2035. The increasing reliance on digital communication solutions across various sectors, including healthcare, finance, and education, contributes to this upward trend. As organizations continue to prioritize effective communication strategies, the market is likely to witness further expansion, driven by technological advancements and evolving consumer preferences.

Growing Focus on Customer Experience

Enhancing customer experience is a driving force in the Global Communication Platform as a Service Market Industry. Organizations are prioritizing communication tools that facilitate personalized interactions and timely responses. This focus on customer satisfaction is leading to increased investments in advanced communication solutions. Metrics indicate that companies leveraging effective communication platforms can improve customer retention rates significantly. As the market evolves, the emphasis on customer-centric communication strategies is likely to propel growth, contributing to the projected CAGR of 6.3% from 2025 to 2035.

Integration of Artificial Intelligence

The integration of artificial intelligence into communication platforms is transforming the Global Communication Platform as a Service Market Industry. AI technologies enhance user experience by providing features such as chatbots, predictive analytics, and automated responses. These innovations streamline communication processes and improve customer engagement. As businesses increasingly recognize the value of AI-driven solutions, the market is expected to expand significantly. The anticipated growth from 12.8 USD Billion in 2024 to 25 USD Billion by 2035 suggests that AI will play a crucial role in shaping the future of communication services.

Increased Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is a key driver in the Global Communication Platform as a Service Market Industry. Organizations are increasingly migrating their communication infrastructures to the cloud to benefit from scalability, flexibility, and cost-effectiveness. This transition allows businesses to deploy communication tools rapidly and adapt to changing needs. The market's growth is underscored by the anticipated increase in value from 12.8 USD Billion in 2024 to 25 USD Billion by 2035. Cloud-based communication platforms are becoming essential for organizations seeking to enhance operational efficiency and collaboration.

Regulatory Compliance and Security Concerns

Regulatory compliance and security concerns are pivotal factors influencing the Global Communication Platform as a Service Market Industry. As data privacy regulations become more stringent, organizations are compelled to adopt communication solutions that ensure compliance and protect sensitive information. This necessity drives demand for platforms that offer robust security features and adhere to regulatory standards. The market's growth trajectory is likely to be supported by the increasing emphasis on data protection, as businesses recognize the importance of secure communication channels in maintaining customer trust and regulatory adherence.

Rising Demand for Remote Communication Solutions

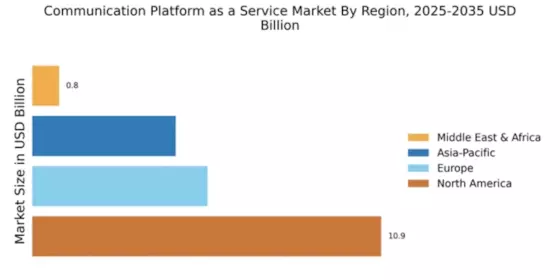

The Global Communication Platform as a Service Market Industry experiences a notable surge in demand for remote communication solutions. As organizations increasingly adopt hybrid work models, the need for effective communication tools becomes paramount. This trend is reflected in the projected market value of 12.8 USD Billion in 2024, indicating a robust growth trajectory. Companies are investing in platforms that facilitate seamless collaboration, video conferencing, and messaging, which are essential for maintaining productivity in remote settings. The shift towards digital communication channels is likely to continue driving growth in this sector.