Rising Awareness of Orthopedic Health

There is a growing awareness of orthopedic health among the Indian population, which is contributing to the expansion of the orthopedic devices market. Educational campaigns and health programs are increasingly emphasizing the importance of early diagnosis and treatment of orthopedic conditions. This heightened awareness is leading to more individuals seeking medical advice and treatment for their orthopedic issues. As a result, the demand for orthopedic devices, such as implants and supports, is likely to increase. Market data suggests that the orthopedic devices market is projected to grow at a CAGR of around 8% over the next five years, driven by this increasing awareness and proactive health management among the population.

Growth of the Sports and Fitness Industry

The burgeoning sports and fitness industry in India is emerging as a significant driver for the orthopedic devices market. With an increasing number of individuals participating in sports and fitness activities, the incidence of sports-related injuries is also on the rise. This trend necessitates the use of orthopedic devices such as braces, supports, and rehabilitation equipment. Market analysis indicates that the sports and fitness sector is expected to grow at a CAGR of over 10% in the coming years, which will likely lead to a corresponding increase in demand for orthopedic devices. As fitness awareness continues to rise, the orthopedic devices market is poised to benefit from the need for effective injury prevention and recovery solutions.

Increasing Incidence of Orthopedic Disorders

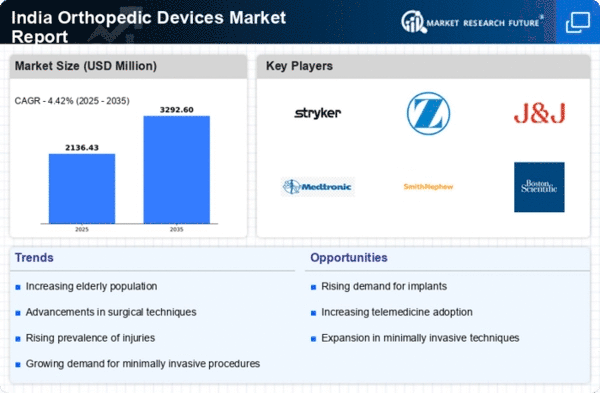

The rising prevalence of orthopedic disorders in India is a primary driver for the orthopedic devices market. Conditions such as osteoarthritis, rheumatoid arthritis, and sports injuries are becoming more common, particularly among the aging population. According to recent estimates, approximately 15% of the Indian population suffers from some form of arthritis, leading to a growing need for orthopedic interventions. This trend is likely to escalate as the population ages, with projections indicating that by 2030, the elderly demographic will constitute about 20% of the total population. Consequently, the demand for orthopedic devices, including joint replacements and braces, is expected to surge, thereby propelling the growth of the orthopedic devices market. The healthcare sector is responding by increasing the availability of these devices, which further supports market expansion.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving healthcare infrastructure and accessibility are significantly influencing the orthopedic devices market. The Indian government has launched various schemes to enhance healthcare services, including the Ayushman Bharat scheme, which aims to provide health insurance to economically disadvantaged populations. Such policies are likely to increase access to orthopedic treatments and devices, thereby driving market growth. Furthermore, the government's focus on promoting Make in India initiatives encourages domestic manufacturing of orthopedic devices, which could reduce costs and improve availability. As a result, the orthopedic devices market is expected to benefit from these supportive policies, leading to increased adoption of advanced orthopedic solutions across the country.

Technological Innovations in Device Manufacturing

Technological advancements in the manufacturing of orthopedic devices are playing a crucial role in shaping the market landscape. Innovations such as 3D printing, robotics, and smart materials are enhancing the design and functionality of orthopedic devices. These technologies not only improve the precision and effectiveness of devices but also reduce production costs, making them more accessible to healthcare providers and patients. The orthopedic devices market is witnessing a shift towards minimally invasive surgical techniques, which are facilitated by these technological innovations. As a result, the market is likely to experience growth as healthcare professionals adopt these advanced solutions to improve patient outcomes and streamline surgical procedures.