Increased Healthcare Expenditure

The increase in healthcare expenditure in the UK is a significant factor influencing the orthopedic devices market. The UK government has been investing heavily in healthcare infrastructure, with the National Health Service (NHS) budget reaching £192 billion in 2025. This increase in funding allows for the procurement of advanced orthopedic devices, enhancing patient care and treatment outcomes. Furthermore, as healthcare spending rises, hospitals and clinics are more likely to adopt cutting-edge technologies and devices, which can improve surgical precision and recovery times. The orthopedic devices market is expected to benefit from this trend, as healthcare providers aim to provide the latest innovations to their patients. With an anticipated growth rate of 6% in healthcare spending over the next few years, the demand for orthopedic devices is poised to rise correspondingly, reflecting the commitment to improving musculoskeletal health in the UK.

Expansion of E-commerce in Medical Devices

The expansion of e-commerce platforms in the medical devices sector is emerging as a crucial driver for the orthopedic devices market. The convenience of online shopping has transformed how consumers access orthopedic products, allowing for greater availability and competitive pricing. In the UK, e-commerce sales of medical devices have increased by 30% in the past year, reflecting a shift in consumer purchasing behavior. This trend is particularly relevant for orthopedic devices, as patients often seek specific products for rehabilitation and injury prevention. The growth of telemedicine and online consultations further supports this shift, enabling patients to receive recommendations and purchase devices from the comfort of their homes. As e-commerce continues to grow, the orthopedic devices market is likely to see enhanced distribution channels and increased sales, contributing to overall market expansion.

Growing Awareness of Preventive Healthcare

The rising awareness of preventive healthcare among the UK population is influencing the orthopedic devices market positively. As individuals become more conscious of their health and the importance of maintaining an active lifestyle, there is a growing demand for preventive orthopedic solutions. This includes devices such as braces, supports, and orthotics that help prevent injuries and manage existing conditions. Educational campaigns and initiatives aimed at promoting physical activity and injury prevention are contributing to this trend. The orthopedic devices market is likely to see an increase in sales of preventive devices, as consumers seek to protect themselves from potential musculoskeletal issues. With an estimated growth rate of 4.5% in the preventive healthcare segment, the orthopedic devices market stands to benefit from this shift towards proactive health management.

Rising Incidence of Musculoskeletal Disorders

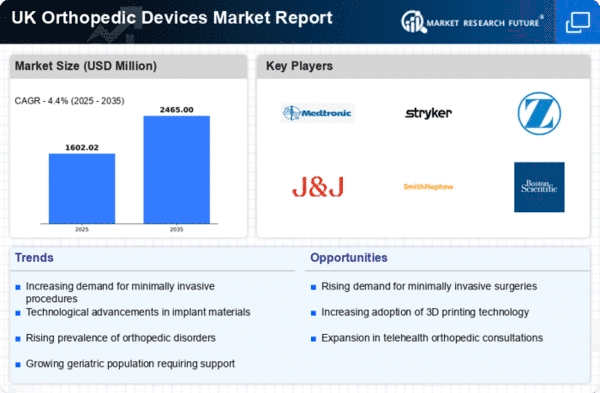

The increasing prevalence of musculoskeletal disorders in the UK is a primary driver for the orthopedic devices market. Conditions such as arthritis, osteoporosis, and sports-related injuries are becoming more common, leading to a higher demand for orthopedic solutions. According to recent data, approximately 28 million people in the UK are affected by musculoskeletal disorders, which represents around 43% of the adult population. This growing patient base necessitates the development and distribution of advanced orthopedic devices, including joint replacements and braces. As the population ages and lifestyles become more sedentary, the orthopedic devices market is likely to expand significantly, with projections indicating a compound annual growth rate (CAGR) of 5.5% over the next five years. This trend underscores the urgent need for innovative orthopedic solutions to address the rising burden of musculoskeletal conditions.

Technological Innovations in Orthopedic Devices

Technological advancements are reshaping the orthopedic devices market, driving growth and enhancing treatment options. Innovations such as 3D printing, robotics, and smart materials are revolutionizing the design and functionality of orthopedic devices. For instance, 3D-printed implants can be customized to fit individual patients, improving surgical outcomes and reducing recovery times. The integration of robotics in surgical procedures allows for greater precision and minimally invasive techniques, which are increasingly preferred by both surgeons and patients. As these technologies become more accessible, the orthopedic devices market is likely to experience a surge in demand. The market is projected to grow at a CAGR of 7% over the next five years, driven by the continuous evolution of technology and the increasing adoption of advanced orthopedic solutions in clinical settings.