Increased Healthcare Expenditure

Rising healthcare expenditure in the US is significantly impacting the orthopedic devices market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing investment in advanced medical technologies, including orthopedic devices. This increase in funding allows for better access to innovative treatments and surgical procedures, thereby driving demand for orthopedic devices. Furthermore, as insurance coverage expands, more patients are likely to seek surgical interventions for orthopedic conditions, further propelling market growth. The orthopedic devices market stands to benefit from this trend, as healthcare providers invest in state-of-the-art devices to enhance patient care.

Growing Awareness of Preventive Care

There is a notable increase in awareness regarding preventive care and early intervention in orthopedic health, which is influencing the orthopedic devices market. Educational campaigns and community health initiatives are encouraging individuals to seek medical advice for musculoskeletal issues before they escalate. This proactive approach is leading to earlier diagnoses and, consequently, a higher demand for orthopedic devices. As patients become more informed about their health options, the orthopedic devices market is likely to see a rise in the adoption of preventive solutions, including braces and supports, which can mitigate the progression of orthopedic disorders.

Expansion of Outpatient Surgical Centers

The expansion of outpatient surgical centers in the US is a significant driver for the orthopedic devices market. These facilities offer a more cost-effective and efficient alternative to traditional hospital settings for orthopedic surgeries. As more procedures are performed in outpatient settings, the demand for orthopedic devices is expected to rise. This trend is supported by advancements in minimally invasive surgical techniques, which allow for quicker recovery times and reduced hospital stays. Consequently, the orthopedic devices market is likely to experience growth as outpatient centers increasingly adopt innovative devices to enhance surgical outcomes and patient satisfaction.

Rising Incidence of Orthopedic Disorders

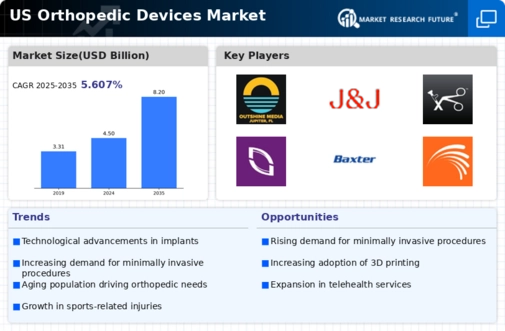

The increasing prevalence of orthopedic disorders in the US is a primary driver for the orthopedic devices market. Conditions such as osteoarthritis, rheumatoid arthritis, and sports-related injuries are becoming more common, particularly among the aging population. According to recent data, approximately 54 million adults in the US are diagnosed with arthritis, which significantly contributes to the demand for orthopedic devices. This trend is expected to continue, as the population ages and more individuals engage in high-impact sports. The orthopedic devices market is projected to grow as healthcare providers seek effective solutions to manage these conditions, leading to an increase in surgical procedures and the adoption of advanced orthopedic devices.

Technological Innovations in Device Design

Technological advancements in the design and manufacturing of orthopedic devices are reshaping the orthopedic devices market. Innovations such as 3D printing, smart implants, and enhanced materials are improving the functionality and longevity of devices. For instance, the introduction of bioresorbable implants is gaining traction, as they eliminate the need for a second surgery to remove hardware. The orthopedic devices market is witnessing a shift towards personalized medicine, where devices are tailored to individual patient needs. This trend not only enhances patient outcomes but also drives market growth, as healthcare providers increasingly adopt these cutting-edge technologies to improve surgical results.