Rising Demand for Autonomous Vehicles

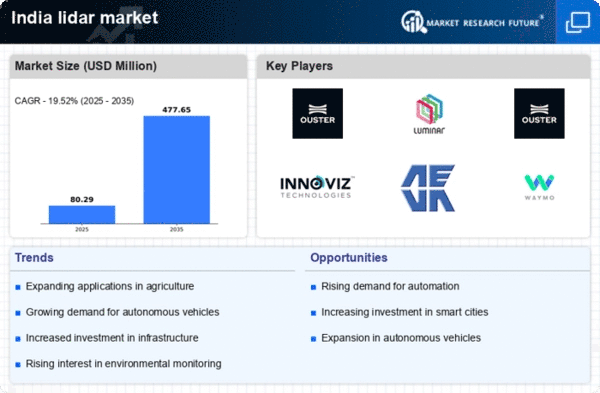

The increasing demand for autonomous vehicles in India is a pivotal driver for the lidar market. As automotive manufacturers strive to enhance safety and efficiency, lidar technology emerges as a crucial component for navigation and obstacle detection. The Indian government has set ambitious targets for electric and autonomous vehicles, which could lead to a market growth rate of approximately 20% annually. This trend indicates a robust future for lidar applications in the automotive sector, as companies invest heavily in research and development to integrate advanced sensor technologies. The lidar market is likely to benefit from partnerships between automotive firms and technology providers, fostering innovation and expanding the scope of lidar applications in vehicle automation.

Urbanization and Smart City Initiatives

Rapid urbanization in India is driving the need for smart city solutions, which significantly impacts the lidar market. As cities expand, the demand for efficient infrastructure management and urban planning increases. Lidar technology offers precise 3D mapping capabilities, essential for urban development projects. The Indian government has allocated over $1 billion for smart city initiatives, which may lead to a surge in lidar adoption for applications such as traffic management, environmental monitoring, and urban planning. This investment suggests a growing recognition of the importance of advanced technologies in addressing urban challenges, thereby creating a favorable environment for the lidar market to thrive.

Advancements in Data Processing Technologies

The evolution of data processing technologies is a key driver for the lidar market in India. As lidar systems generate vast amounts of data, the need for efficient processing and analysis becomes paramount. Innovations in artificial intelligence and machine learning are enhancing the capabilities of lidar data interpretation, making it more accessible for various applications. This technological advancement could lead to a market growth rate of around 18% in the coming years, as industries recognize the value of actionable insights derived from lidar data. The lidar market is likely to experience increased adoption across sectors such as agriculture, forestry, and urban planning, driven by the demand for sophisticated data analytics.

Growing Interest in Environmental Monitoring

The increasing awareness of environmental issues in India is propelling the lidar market forward. Lidar technology is instrumental in monitoring air quality, vegetation, and land use changes, which are critical for sustainable development. With the Indian government emphasizing environmental conservation, there is a potential for significant investment in technologies that support ecological monitoring. Reports suggest that the market for environmental monitoring solutions could grow by 15% annually, indicating a strong demand for lidar applications in this sector. This trend highlights the potential for the lidar market to contribute to environmental sustainability efforts, aligning with national priorities and global environmental goals.

Increased Investment in Infrastructure Development

India's ongoing infrastructure development projects are a substantial driver for the lidar market. The government has committed to investing approximately $1.4 trillion in infrastructure over the next five years, focusing on transportation, energy, and urban development. Lidar technology plays a vital role in surveying and mapping, enabling accurate assessments of land and resources. This investment is likely to enhance the demand for lidar solutions in construction and civil engineering, as companies seek to improve project efficiency and reduce costs. The lidar market stands to gain from this trend, as stakeholders recognize the value of high-resolution data in facilitating informed decision-making and project management.