Growth of IoT Ecosystem

The rapid expansion of the Internet of Things (IoT) ecosystem in India is a significant driver for the embedded ai market. With an estimated 1.5 billion connected devices by 2025, the demand for intelligent embedded systems is surging. These systems are essential for processing data locally, enabling real-time decision-making and enhancing operational efficiency. Industries such as agriculture, manufacturing, and logistics are increasingly adopting IoT solutions, which often incorporate embedded AI to optimize processes. This trend indicates a strong potential for growth in the embedded ai market, as companies seek to leverage AI capabilities to improve productivity and reduce costs.

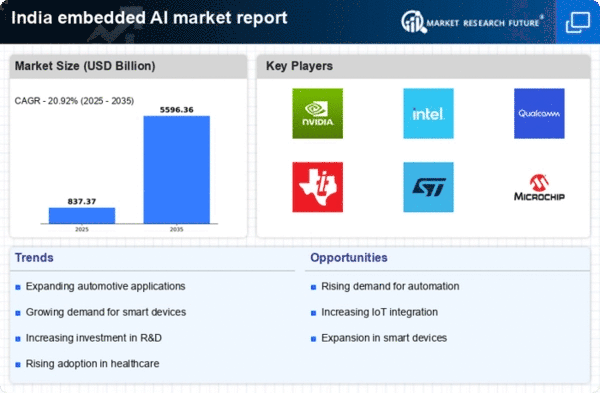

Rising Demand for Smart Devices

The proliferation of smart devices in India is a key driver for the The proliferation of smart devices in India is a key driver for growth.. As consumers increasingly seek advanced functionalities in their gadgets, manufacturers are integrating AI capabilities to enhance user experience. This trend is evident in sectors such as consumer electronics, where smart home devices are projected to grow at a CAGR of 25% from 2025 to 2030. The embedded ai market is likely to benefit from this surge, as companies invest in AI technologies to meet consumer expectations. Furthermore, the Indian government’s push for digitalization and smart city initiatives is expected to further stimulate demand for smart devices, thereby propelling the embedded ai market forward.

Government Initiatives and Support

Government initiatives aimed at promoting AI technologies are significantly impacting the embedded ai market in India. Programs such as the National AI Strategy and various funding schemes for startups are fostering innovation in AI applications. The government has allocated approximately $1 billion to support AI research and development, which is likely to enhance the capabilities of embedded systems. This support not only encourages local startups to develop AI solutions but also attracts foreign investments, thereby expanding the embedded ai market. As a result, the collaboration between government and industry stakeholders is expected to drive advancements in AI technologies, further solidifying India's position in the embedded ai market.

Increasing Focus on Energy Efficiency

The growing emphasis on energy efficiency is emerging as a vital driver for the embedded ai market in India. As industries strive to reduce their carbon footprint and operational costs, the integration of AI in embedded systems is becoming increasingly important. AI algorithms can optimize energy consumption in real-time, leading to significant savings. For instance, smart grids and energy management systems are utilizing embedded AI to enhance efficiency. This focus on sustainability is likely to propel the embedded ai market, as companies seek innovative solutions to meet regulatory requirements and consumer expectations for greener technologies.

Advancements in Semiconductor Technology

Advancements in semiconductor technology are playing a crucial role in shaping the embedded ai market in India. The development of smaller, more efficient chips enables the integration of AI algorithms directly into devices, enhancing their performance and capabilities. As semiconductor manufacturers invest in research and development, the cost of producing AI-enabled chips is expected to decrease, making them more accessible to a wider range of industries. This trend is likely to drive innovation in the embedded ai market, as companies can now implement AI solutions in various applications, from consumer electronics to industrial automation, thereby expanding the market's reach.