Government Initiatives and Support

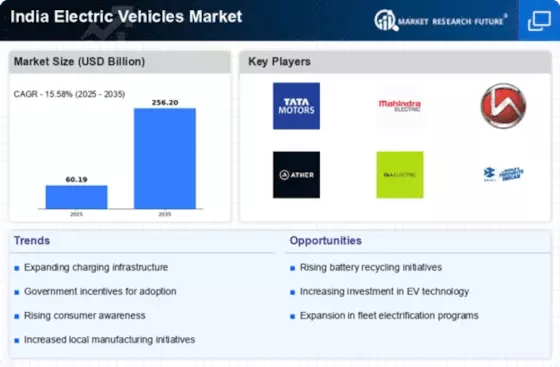

The India Electric Vehicles Market is significantly influenced by government initiatives aimed at promoting electric mobility. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme has allocated substantial funds to incentivize electric vehicle (EV) adoption. As of January 2026, the government has set a target of achieving 30 percent electric vehicle penetration by 2030, which indicates a robust commitment to reducing carbon emissions and enhancing energy security. Additionally, various state governments are implementing their own policies, such as tax exemptions and subsidies, to further stimulate the market. This supportive regulatory environment is likely to attract investments and encourage manufacturers to expand their EV offerings, thereby accelerating the growth of the India Electric Vehicles Market.

Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the India Electric Vehicles Market. As manufacturers strive to enhance the performance and affordability of electric vehicles, significant resources are being allocated to R&D initiatives. In January 2026, several Indian automotive companies are collaborating with technology firms to innovate in areas such as battery technology, vehicle design, and smart mobility solutions. This focus on R&D is likely to lead to breakthroughs that could improve the efficiency and appeal of electric vehicles. Moreover, government support for R&D initiatives, including grants and tax incentives, is expected to foster innovation within the industry. This commitment to advancing technology is poised to strengthen the competitive landscape of the India Electric Vehicles Market.

Rising Fuel Prices and Economic Factors

The India Electric Vehicles Market is experiencing a shift in consumer behavior due to rising fuel prices. As petrol and diesel prices continue to escalate, the cost of ownership for traditional internal combustion engine vehicles becomes less attractive. In January 2026, the average price of petrol in India has reached approximately INR 100 per liter, prompting consumers to consider electric vehicles as a more economical alternative. Additionally, the total cost of ownership for electric vehicles is projected to decrease as battery prices decline and technology improves. This economic pressure is likely to drive more consumers towards electric vehicles, thereby contributing to the growth of the India Electric Vehicles Market.

Environmental Concerns and Sustainability

The growing awareness of environmental issues is a significant driver for the India Electric Vehicles Market. As climate change becomes an increasingly pressing concern, consumers and businesses alike are seeking sustainable transportation solutions. The Indian government has committed to reducing greenhouse gas emissions, and electric vehicles are seen as a viable solution to achieve these targets. In January 2026, public sentiment is shifting towards eco-friendly alternatives, with many consumers actively seeking to reduce their carbon footprint. This trend is likely to encourage the adoption of electric vehicles, as they offer a cleaner and more sustainable mode of transportation. The emphasis on sustainability is expected to further propel the growth of the India Electric Vehicles Market.

Technological Innovations in Charging Infrastructure

The development of charging infrastructure is a critical driver for the India Electric Vehicles Market. As of January 2026, the country has witnessed a surge in the establishment of public and private charging stations, with over 1,000 fast-charging stations operational across major cities. This expansion is essential for alleviating range anxiety among potential EV buyers. Furthermore, advancements in charging technology, such as ultra-fast chargers and wireless charging solutions, are likely to enhance the convenience of EV ownership. The government is also collaborating with private players to create a seamless charging network, which could potentially lead to increased consumer confidence in electric vehicles. This growing infrastructure is expected to play a pivotal role in the widespread adoption of electric vehicles in India.