Top Industry Leaders in the India Electric Vehicle Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the India Electric Vehicle industry are:

BMW Group (Germany)

Daimler AG (Germany)

Toyota(Japan)

Volkswagen (Germany)

Renault Group (France)

Ford Motor Company (U.S.)

Mahindra & Mahindra (India)

TATA motors (India)

Hyundai (South Korea)

MG Motors (U.K.)

Ola Electric (India)

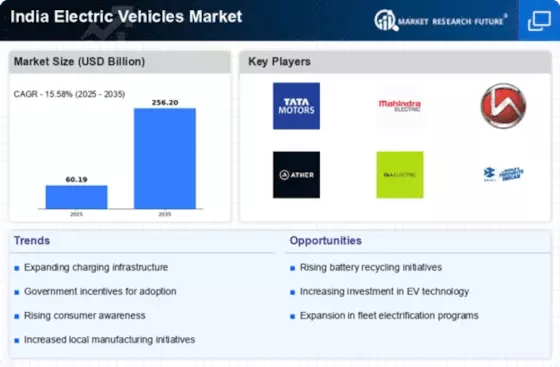

The Indian electric vehicle (EV) market is a burgeoning giant, boasting an impressive CAGR exceeding electrifying surge has attracted a diverse array of players, each strategizing to claim their stake in this promising landscape. Delving into the competitive scenario, we encounter key factors influencing market share, emerging trends, and distinct approaches adopted by prominent players.

Market Share Mechanics:

• Segment Focus: Different EV segments present varied opportunities. Two-wheelers currently lead the charge, driven by their affordability and urban commute suitability. Companies like Hero Electric and Ather Energy dominate this segment. Four-wheelers, including Tata Motors' Nexon EV and MG Motor's ZS EV, witness increasing traction, particularly in the SUV space. Commercial vehicles also hold potential, with Mahindra & Mahindra leading the charge with its electric three-wheelers.

• Pricing and Affordability: Price remains a crucial differentiator, especially for cost-conscious Indian consumers. Established automakers like Tata Motors leverage existing manufacturing infrastructure and economies of scale to offer competitive prices. Startups like Ather Energy, though premium, bank on cutting-edge technology and unique features to justify their pricing.

• Distribution and Charging Infrastructure: Limited charging infrastructure remains a key bottleneck. Companies like Tata Power and Fortum are actively setting up charging stations, while others like Ather Energy are building self-reliant ecosystems with integrated charging solutions.

Player Strategies and Trends:

• Established Automakers: Traditional giants like Tata Motors and Mahindra & Mahindra leverage their extensive reach and brand recognition to establish themselves as frontrunners. They focus on affordable mass-market vehicles and actively partner with the government for FAME-II scheme benefits.

• New Entrants: Start-ups like Ather Energy and Ola Electric bring fresh perspectives and technological innovation. They focus on premium segments, offering high-performance EVs with smart features and connected technology. Direct-to-consumer sales models and innovative financing options are their key differentiators.

• Foreign Players: Global giants like Hyundai and MG Motor are entering the fray, capitalizing on their global expertise and established EV offerings. They aim to bridge the premium gap with feature-rich vehicles and established quality standards.

• Emerging Trends: Battery swapping technology, subscription models for two-wheelers, and focus on commercial vehicles are gaining traction. Additionally, collaborations between players are increasing, fostering technology and infrastructure development.

Competitive Scenario:

The Indian EV market is currently moderately consolidated, with the top five players holding over 50% share. However, the landscape is rapidly evolving, with new entrants challenging established players. Intense competition is driving innovation, product differentiation, and aggressive marketing strategies. Government policies and consumer preferences will play a crucial role in shaping the future competitive landscape.

The Indian EV market is a thrilling arena brimming with potential. Understanding the key players, their strategies, and emerging trends is crucial for anyone navigating this dynamic landscape. With continued government support, technological advancements, and evolving consumer preferences, the Indian EV market is poised for an electrifying future.

Latest Company Updates:

Toyota: Launched the Hyryder hybrid SUV in India. Exploring battery electric vehicles for the future, but no concrete plans yet. (Source: Economic Times, Nov 2023)

Volkswagen Group: Launched the ID.4 electric SUV in India. Plans to introduce more EV models under the Skoda and Audi brands in the coming years. (Source: CarandBike, Sept 2023)

TATA Motors: Dominates the Indian EV market with a 72% share. Launched the Tiago EV, Nexon EV, and Tigor EV. Plans to invest INR 25,000 crore in EVs by 2026.