Rising Awareness and Patient Engagement

Increasing awareness about heart health and the importance of monitoring is driving the Implantable Cardiac Monitors Market. Patients are becoming more engaged in their healthcare decisions, seeking out technologies that provide insights into their cardiac health. Educational initiatives and campaigns aimed at promoting heart health are contributing to this trend, leading to a greater acceptance of implantable devices. Furthermore, as patients become more informed, they are more likely to advocate for advanced monitoring solutions, thereby influencing healthcare providers to adopt these technologies. Market data suggests that patient engagement strategies are linked to improved health outcomes, which in turn fuels the demand for implantable cardiac monitors. This heightened awareness is likely to continue shaping the market landscape in the coming years.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is a pivotal driver for the Implantable Cardiac Monitors Market. As healthcare systems worldwide shift towards proactive management of health conditions, the demand for devices that can monitor cardiac health continuously is rising. This trend is particularly evident in populations at risk for cardiovascular diseases, where early detection can lead to better outcomes. The market is witnessing an increase in partnerships between technology firms and healthcare providers to develop solutions that facilitate preventive care. Data indicates that the preventive healthcare market is expected to reach substantial figures, further propelling the adoption of implantable cardiac monitors. This shift not only enhances patient care but also reduces long-term healthcare costs, making it a compelling driver for market growth.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are crucial drivers for the Implantable Cardiac Monitors Market. Governments and regulatory bodies are increasingly recognizing the importance of these devices in managing cardiac health, leading to streamlined approval processes. This regulatory environment encourages innovation and investment in the development of new monitoring technologies. Additionally, reimbursement policies that cover the costs associated with implantable cardiac monitors are essential for their widespread adoption. As healthcare systems evolve, there is a growing trend towards including these devices in insurance coverage, making them more accessible to patients. This supportive framework is likely to enhance market growth, as it reduces financial barriers and encourages healthcare providers to integrate implantable cardiac monitors into their practice.

Aging Population and Rising Cardiovascular Diseases

The aging population is a significant factor influencing the Implantable Cardiac Monitors Market. As individuals age, the prevalence of cardiovascular diseases tends to increase, necessitating advanced monitoring solutions. The demographic shift towards an older population is prompting healthcare systems to seek effective ways to manage chronic conditions, including heart diseases. Statistics reveal that by 2030, the number of individuals aged 65 and older is expected to double, leading to a higher demand for implantable cardiac monitors. This demographic trend is likely to drive market growth as healthcare providers aim to implement more effective monitoring strategies for this vulnerable population. Consequently, the industry is poised for expansion as it adapts to meet the needs of an aging society.

Technological Advancements in Implantable Cardiac Monitors

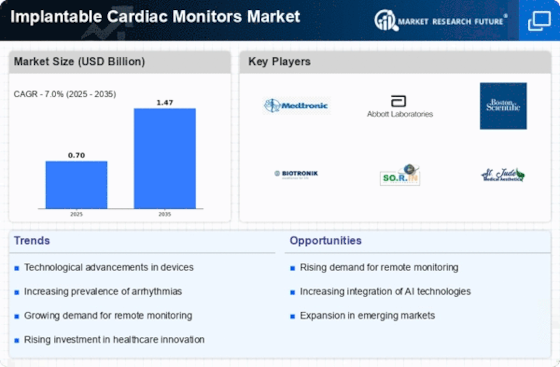

The Implantable Cardiac Monitors Market is experiencing a surge in technological advancements that enhance device functionality and patient outcomes. Innovations such as miniaturization, wireless connectivity, and advanced algorithms for data analysis are becoming increasingly prevalent. These developments allow for real-time monitoring of cardiac health, enabling timely interventions. The integration of artificial intelligence and machine learning into these devices is also noteworthy, as it facilitates predictive analytics, potentially improving patient management. According to recent data, the market for implantable cardiac monitors is projected to grow at a compound annual growth rate of approximately 8% over the next several years, driven by these technological innovations. As a result, healthcare providers are more inclined to adopt these advanced devices, thereby expanding the overall market.