Growth of the Aging Population

The demographic shift towards an aging population is a critical driver of the Catheters and Active Implantable CDMO Market. As individuals age, they are more susceptible to chronic health conditions that often require catheterization and implantable devices for management. The World Health Organization estimates that the number of people aged 60 years and older will reach 2 billion by 2050, creating a substantial demand for medical devices tailored to this demographic. This trend is prompting CDMOs to enhance their product offerings and develop innovative solutions that cater to the unique needs of older patients. Consequently, the market is poised for robust growth as the aging population continues to expand.

Rising Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the Catheters and Active Implantable CDMO Market. As healthcare providers increasingly focus on tailored treatment plans, the demand for customized catheters and implantable devices is on the rise. This trend is particularly evident in oncology and cardiology, where patient-specific factors dictate device design and functionality. CDMOs are adapting to this demand by offering flexible manufacturing solutions that allow for rapid prototyping and production of personalized devices. The market for personalized medical devices is expected to expand significantly, with projections indicating a growth rate of around 8% annually, reflecting the increasing emphasis on individualized patient care.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cardiovascular disorders, diabetes, and renal failure is significantly influencing the Catheters and Active Implantable CDMO Market. As these conditions often require long-term management and intervention, the demand for catheters and implantable devices is expected to rise correspondingly. According to recent data, the prevalence of cardiovascular diseases is projected to reach 23.6 million by 2030, necessitating the use of advanced catheter technologies for effective treatment. This growing patient population is likely to drive the need for innovative CDMO solutions that can cater to the specific requirements of these medical devices, thereby fostering market growth.

Regulatory Changes and Compliance Requirements

The Catheters and Active Implantable CDMO Market is heavily influenced by evolving regulatory frameworks and compliance requirements. Regulatory bodies are continuously updating guidelines to ensure the safety and efficacy of medical devices, which impacts the development and manufacturing processes of catheters and implantable devices. CDMOs must navigate these complex regulations to maintain market access and ensure product approval. The increasing focus on quality assurance and risk management is prompting CDMOs to invest in advanced quality control systems and processes. This regulatory landscape is likely to drive innovation and operational efficiency within the industry, as companies strive to meet stringent compliance standards.

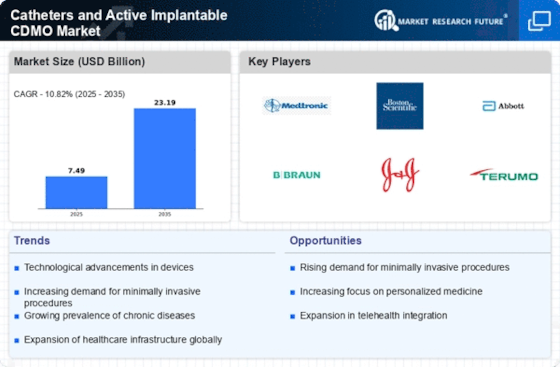

Technological Innovations in Catheters and Active Implantable CDMO Market

The Catheters and Active Implantable CDMO Market is experiencing a surge in technological innovations, which are enhancing the functionality and efficiency of catheters and implantable devices. Advancements such as smart catheters equipped with sensors and wireless communication capabilities are becoming increasingly prevalent. These innovations not only improve patient outcomes but also streamline the manufacturing processes for contract development and manufacturing organizations (CDMOs). The integration of materials science and engineering has led to the development of biocompatible materials that reduce the risk of infection and improve patient comfort. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 7.5% over the next five years, driven by these technological advancements.