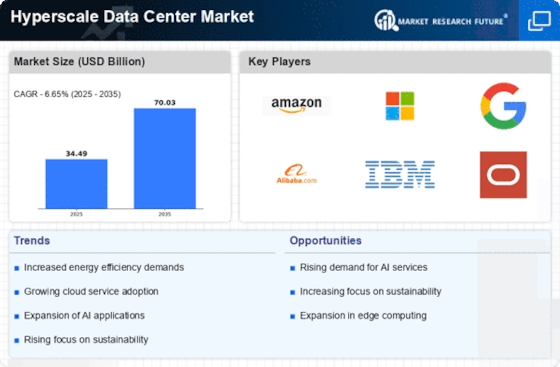

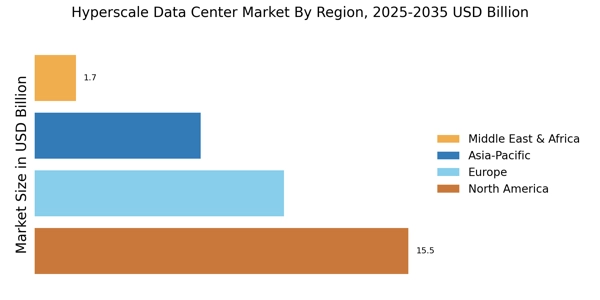

North America : Leading Innovation Hub

North America is the largest market for hyperscale data centers, holding approximately 45% of the global market share. The region's growth is driven by increasing demand for cloud services, big data analytics, and AI applications. Regulatory support, such as tax incentives for data center investments, further catalyzes this growth. The U.S. government has also emphasized the importance of data security and infrastructure development, enhancing the market's appeal. The competitive landscape is dominated by major players like Amazon, Microsoft, and Google, which are continuously expanding their data center footprints. The presence of advanced technology and skilled workforce in the U.S. and Canada fosters innovation.

Additionally, states like Virginia and Texas are emerging as key locations due to favorable regulations and infrastructure, making them attractive for hyperscale investments. Ongoing North America data center trends indicate strong investment in hyperscale facilities across the U.S. and Canada. The hyperscale data centers market is expanding rapidly as hyperscale cloud providers and leading hyperscale data center companies invest in next-generation infrastructure. Growing data center market growth in North America is supported by favorable North America data center trends and increasing deployments by the largest hyperscalers. Adoption of advanced hyperscale technology and AI workloads is further strengthening hyperscale data center growth globally.

Europe : Emerging Powerhouse

Europe is witnessing significant growth in the hyperscale data center market, accounting for about 30% of the global share. The region benefits from increasing digitalization, cloud adoption, and stringent data protection regulations like GDPR, which drive demand for secure data storage solutions. Countries such as Germany and the UK are leading this growth, supported by government initiatives aimed at enhancing digital infrastructure and sustainability efforts. Germany stands out as a key player, with major investments from companies like Equinix and Digital Realty. The competitive landscape is characterized by a mix of local and international players, all vying for market share. The European market is also focusing on sustainability, with many data centers adopting green technologies to meet regulatory requirements and consumer expectations for environmentally friendly operations.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is rapidly emerging as a significant player in the hyperscale data center market, holding approximately 20% of the global market share. The region's growth is fueled by increasing internet penetration, mobile device usage, and the rise of e-commerce. Countries like China and India are at the forefront, with government initiatives promoting digital transformation and investments in data center infrastructure, further driving demand in the sector. China, led by companies like Alibaba and Tencent, is the largest market in the region, while India is quickly catching up with its expanding tech ecosystem. The competitive landscape is marked by a mix of domestic and international players, all striving to capitalize on the growing demand. Additionally, the region is witnessing a trend towards edge computing, which is reshaping the data center landscape and enhancing service delivery.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa region is gradually establishing itself in the hyperscale data center market, currently holding about 5% of the global share. The growth is driven by increasing investments in digital infrastructure, government initiatives to promote technology adoption, and the rising demand for cloud services. Countries like the UAE and South Africa are leading the charge, with significant projects aimed at enhancing data center capabilities and connectivity. The competitive landscape is evolving, with both local and international players entering the market. The UAE, particularly Dubai, is becoming a hub for data centers due to its strategic location and favorable business environment. Additionally, the region is focusing on sustainability and energy efficiency, aligning with global trends and regulatory expectations, which is crucial for attracting further investments.