Rapid Digital Transformation

The ongoing digital transformation across various sectors in China is a primary driver for the hyperscale data-center market. As businesses increasingly adopt cloud computing, big data analytics, and IoT technologies, the demand for robust data infrastructure intensifies. In 2025, the digital economy in China is projected to reach approximately $6 trillion, indicating a substantial growth trajectory. This surge necessitates the establishment of hyperscale data centers to support the vast amounts of data generated. Furthermore, the Chinese government has been promoting digitalization initiatives, which further catalyze investments in data center infrastructure. The hyperscale data-center market is thus positioned to benefit significantly from this digital shift, as enterprises seek scalable and efficient solutions to manage their data needs.

Government Policies and Incentives

Government policies in China play a crucial role in shaping the hyperscale data-center market. The Chinese government has introduced various incentives aimed at promoting the development of data centers, including tax breaks and subsidies for energy-efficient technologies. In 2025, the government aims to enhance the digital infrastructure, with investments expected to exceed $100 billion in the next five years. These policies not only encourage domestic companies to invest in hyperscale data centers but also attract foreign investments. The regulatory framework is evolving to support the growth of this market, ensuring that data centers comply with environmental standards while promoting technological advancements. Consequently, the hyperscale data-center market is likely to experience accelerated growth due to favorable government initiatives.

Increased Demand for Cloud Services

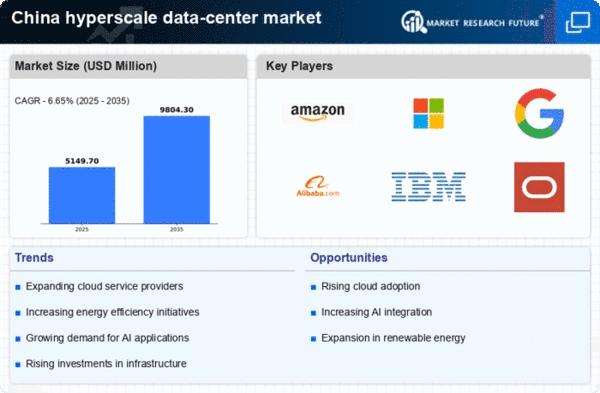

The rising demand for cloud services in China is a significant driver for the hyperscale data-center market. As enterprises transition to cloud-based solutions, the need for expansive and efficient data storage and processing capabilities becomes paramount. In 2025, the cloud services market in China is anticipated to reach $50 billion, reflecting a compound annual growth rate (CAGR) of over 30%. This growth is fueled by the increasing reliance on remote work, digital collaboration tools, and e-commerce platforms. Hyperscale data centers are essential to accommodate this demand, providing the necessary infrastructure to support large-scale cloud operations. As businesses seek to enhance their digital capabilities, the hyperscale data-center market is poised for substantial expansion.

Emerging Technologies and Innovation

The integration of emerging technologies such as artificial intelligence (AI), machine learning, and blockchain is driving the hyperscale data-center market in China. These technologies require substantial computational power and storage capacity, which hyperscale data centers are uniquely positioned to provide. In 2025, the AI market in China is projected to surpass $30 billion, indicating a robust demand for data processing capabilities. As companies increasingly leverage these technologies for competitive advantage, the need for advanced data center solutions becomes critical. The hyperscale data-center market is likely to evolve in response to these technological advancements, fostering innovation and enhancing operational efficiencies across various industries.

Focus on Energy Efficiency and Sustainability

The hyperscale data-center market in China is increasingly influenced by the focus on energy efficiency and sustainability. As environmental concerns grow, data center operators are seeking ways to reduce their carbon footprint and energy consumption. In 2025, energy-efficient data centers are expected to account for over 40% of the market, driven by advancements in cooling technologies and renewable energy sources. The Chinese government has set ambitious targets for carbon neutrality by 2060, prompting data center operators to adopt sustainable practices. This shift not only aligns with regulatory requirements but also meets the expectations of environmentally conscious consumers. Consequently, the hyperscale data-center market is likely to see a rise in investments aimed at enhancing sustainability and energy efficiency.