Rising Demand for Data Storage

The hyperscale data-center market is experiencing a notable surge in demand for data storage solutions. As businesses increasingly rely on digital platforms, the need for vast amounts of data storage has escalated. In India, the data storage capacity is projected to grow at a CAGR of approximately 30% over the next five years. This growth is driven by the proliferation of data-intensive applications, such as artificial intelligence and big data analytics. Consequently, hyperscale data centers are being developed to accommodate this demand, providing scalable and efficient storage solutions. The hyperscale data-center market is thus positioned to benefit from this trend, as organizations seek to enhance their data management capabilities.

Government Initiatives and Policies

The Indian government is actively promoting the development of the hyperscale data-center market through various initiatives and policies. Programs aimed at enhancing digital infrastructure, such as the Digital India initiative, are fostering an environment conducive to data center growth. Additionally, the government has introduced incentives for foreign investments in the technology sector, which could lead to increased funding for hyperscale data centers. The establishment of data protection regulations is also encouraging companies to invest in local data centers, thereby boosting the hyperscale data-center market. These government efforts are likely to create a robust framework for the expansion of data centers across the country.

Growth of E-commerce and Digital Services

The rapid expansion of e-commerce and digital services in India is significantly impacting the hyperscale data-center market. With online retail sales projected to reach $200 billion by 2026, the demand for robust data infrastructure is paramount. E-commerce platforms require reliable and scalable data solutions to manage vast amounts of customer data and transactions. This trend is prompting investments in hyperscale data centers, which can provide the necessary capacity and performance. As digital services continue to proliferate, the hyperscale data-center market is expected to thrive, catering to the needs of various sectors, including retail, finance, and entertainment.

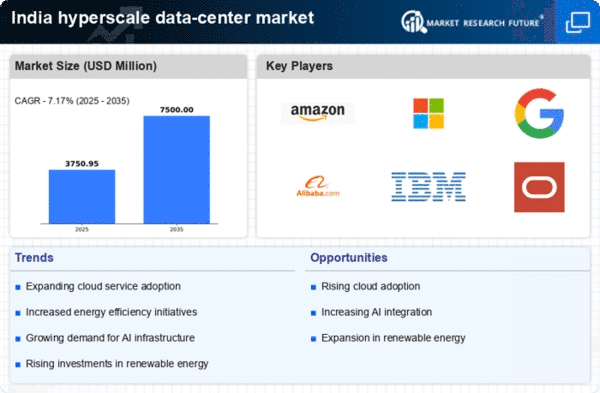

Increased Investment in Cloud Infrastructure

Investment in cloud infrastructure is a key driver of the hyperscale data-center market. As organizations in India transition to cloud-based solutions, the demand for large-scale data centers is intensifying. Reports indicate that cloud spending in India is expected to exceed $10 billion by 2025, reflecting a growing reliance on cloud services. This trend is prompting hyperscale data center operators to expand their facilities to meet the rising demand for cloud storage and computing power. The hyperscale data-center market is thus positioned to capitalize on this investment wave, as businesses seek to leverage cloud technologies for enhanced operational efficiency.

Technological Advancements in Data Center Design

Innovations in data center design and technology are playing a crucial role in shaping the hyperscale data-center market. The adoption of advanced cooling techniques, energy-efficient hardware, and automation technologies is enhancing operational efficiency. For instance, the implementation of liquid cooling systems can reduce energy consumption by up to 30%, which is particularly relevant in India's hot climate. These advancements not only lower operational costs but also improve the sustainability of data centers. As companies increasingly prioritize energy efficiency, the hyperscale data-center market is likely to see a shift towards more innovative and environmentally friendly designs.