Market Analysis

In-depth Analysis of Hydrodesulfurization Catalysts Market Industry Landscape

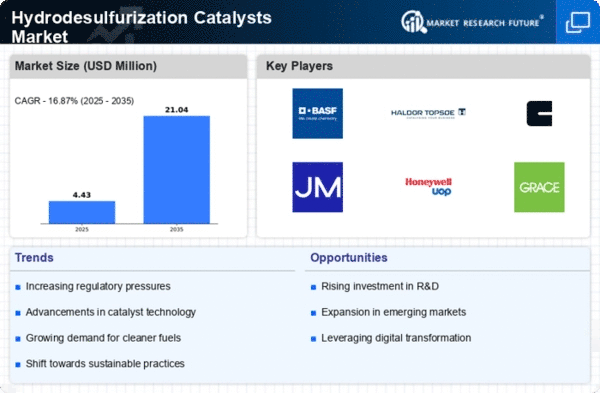

The hydrodesulfurization (HDS) catalysts market operates within a dynamic landscape influenced by various factors that shape supply, demand, and pricing dynamics. HDS catalysts play a critical role in the refining industry by removing sulfur compounds from petroleum feedstocks to meet stringent environmental regulations and produce cleaner fuels. One of the primary drivers of market dynamics is the global demand for cleaner transportation fuels. As countries implement stricter emissions standards to reduce air pollution and combat climate change, the demand for HDS catalysts to produce low-sulfur fuels increases. Factors such as growing urbanization, expanding transportation networks, and increasing vehicle ownership drive demand for cleaner fuels, influencing the adoption of HDS catalysts in refineries worldwide.

The cost of production and distribution for sulfur-free fuels is high as compared to the conventionally produced fuels. The refining facilities necessitate higher capital costs to revamp existing units, precious metal catalystsand installation of new units to meet the stringent sulfur regulations. The transportation sections also require investments for the trustworthy transportation of fuels to customers. Altogether, these factors contribute to the elevated prices of sulfur-free fuels.

Supply dynamics in the HDS catalysts market are influenced by factors such as raw material availability, manufacturing capabilities, and technological advancements. HDS catalysts are typically composed of active metals such as nickel and molybdenum supported on alumina or other high-surface-area materials. The availability and cost of raw materials, including metals, catalyst supports, and additives, impact production costs and supply availability in the market. Manufacturing capabilities, including catalyst synthesis methods, production capacity, and quality control measures, play a crucial role in shaping supply dynamics by determining the ability of manufacturers to meet market demand. Moreover, advancements in catalyst formulation, catalyst support materials, and manufacturing processes contribute to product innovation and market competitiveness.

Market dynamics are further influenced by factors such as refinery operations, regulatory standards, and technological innovations. Refinery operations, including feedstock composition, processing conditions, and catalyst regeneration cycles, influence market dynamics by shaping catalyst requirements and replacement cycles. Regulatory standards related to sulfur emissions, fuel quality, and environmental protection drive demand for HDS catalysts by setting requirements for sulfur content in transportation fuels. Additionally, technological innovations in catalyst design, catalyst preparation methods, and reactor configurations contribute to improving catalyst performance, reducing operating costs, and meeting evolving regulatory requirements.

Pricing dynamics in the HDS catalysts market are influenced by a combination of factors including raw material costs, manufacturing expenses, competitive pressures, and market demand-supply dynamics. Fluctuations in raw material prices, including metals, catalyst supports, and additives, directly impact production costs for HDS catalyst manufacturers, thereby influencing pricing decisions. Manufacturing expenses, including labor costs, energy costs, and overhead expenses, also play a role in determining product pricing. Competitive pressures within the industry, driven by factors such as market concentration, brand reputation, and technological differentiation, influence pricing strategies adopted by catalyst producers. Moreover, demand-supply imbalances, fluctuations in refinery operations, and changes in sulfur regulations can exert short-term pressures on prices.

Environmental considerations and sustainability trends are increasingly shaping market dynamics in the HDS catalysts industry. With growing awareness of environmental issues and sustainability goals, stakeholders across the value chain are prioritizing the use of eco-friendly materials and processes in catalyst manufacturing and refining operations. HDS catalyst producers are responding to this trend by adopting measures to minimize environmental impact, such as reducing energy consumption, optimizing catalyst formulations, and implementing catalyst regeneration technologies. Additionally, certification programs promoting environmentally friendly catalyst products and government incentives for clean fuel production further influence market dynamics by shaping consumer preferences and industry standards.

Leave a Comment