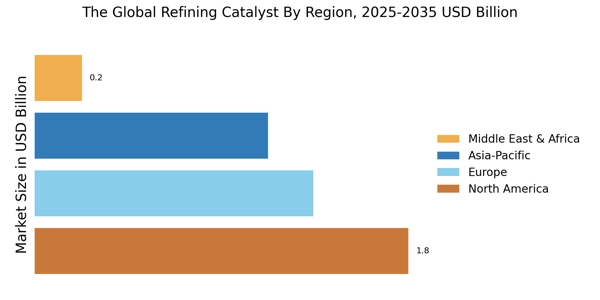

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. Asia Pacific is the largest refining catalyst market in the world. This can be attributed to several factors, including the growing demand for petroleum products in the region, the increasing number of refineries being built and expanded in countries such as China and India, and the implementation of stricter environmental regulations in the region. China and India are among the largest consumers of petroleum products globally.

The growing demand for gasoline and diesel fuels in these countries is driving the demand for refining catalysts to increase the efficiency of the refining process and to produce higher-quality fuels. Additionally, many countries in the Asia Pacific, including China and India, are implementing stricter environmental regulations that limit the amount of sulfur and other pollutants in transportation fuels. This is driving the demand for refining catalysts, particularly hydrotreating catalysts, which can remove impurities from crude oil and other feedstocks to produce cleaner-burning fuels.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil

Europe’s Refining Catalyst market accounts for the third-largest market share. Europe is home to several refineries, and many of them are located in countries such as Germany, France, Italy, and Spain. The presence of these refineries creates a significant demand for refining catalysts, which contributes to Europe's market share in the industry. European countries have some of the strictest environmental regulations in the world, and refineries must comply with these regulations to operate. Refining catalysts can help refineries meet these regulations by reducing emissions and improving efficiency.

Therefore, the demand for refining catalysts in Europe is driven by the need to comply with environmental regulations. Europe is a densely populated region with high levels of economic activity, resulting in high demand for refined products such as gasoline, diesel, and jet fuel. Refining catalysts are essential in improving the efficiency of the refining process, increasing the yield of refined products, and meeting the demand for these products. Further, the Germany Refining Catalyst market held the largest market share, and the UK Refining Catalyst market was the fastest-growing market in the European region.

North America, Refining Catalyst market, is expected to grow at the fastest CAGR from 2023 to 2030. North America is home to several refineries, and many of them are located in the United States. The presence of these refineries creates a significant demand for refining catalysts, which contributes to North America's market share in the industry. The refining industry in North America is highly advanced and employs sophisticated technologies to enhance the efficiency of the refining process.

Refining catalysts play a crucial role in these advanced technologies, and their use contributes to the growth of the refining catalyst market in North America. North America has experienced a significant increase in the production of shale gas in recent years. The abundance of shale gas has led to a surge in demand for refined products such as gasoline and diesel, creating a need for more efficient refining processes that use refining catalysts. Moreover, the U.S. Refining Catalyst market held the largest market share, and the Canada Refining Catalyst market was the fastest-growing market in the North American region.