Top Industry Leaders in the Hydrodesulfurization Catalysts Market

Hydrodesulfurization Catalysts Market

In the hidden world of refineries, where crude oil transforms into usable fuels, a silent hero reigns supreme: the hydrodesulfurization (HDS) catalyst. This unsung champion cleanses the oil of its sulfurous impurities, ensuring cleaner emissions and smoother engine performance. The global HDS catalysts market is a battlefield where established giants and nimble innovators clash for market share. Let's delve into the strategies driving success, the factors influencing dominance, and the recent developments shaping this critical industry.

Strategies for Catalyzing Growth:

-

Performance Optimization: Leading players like BASF and Albemarle Corporation are constantly innovating catalyst formulations to achieve higher desulfurization activity, longer catalyst life, and broader feedstock compatibility. This translates to superior performance, reduced operational costs, and wider market appeal. -

Sustainability Focus: With environmental concerns intensifying, companies like UOP are developing eco-friendly catalysts that minimize energy consumption, reduce waste generation, and comply with stricter emission regulations. This resonates with environmentally conscious refiners and aligns with industry trends. -

Technological Advancements: From zeolite-based catalysts to advanced nano-engineered materials, the HDS landscape is brimming with innovation. Companies like Johnson Matthey are pioneering novel catalyst designs with enhanced activity, selectivity, and resistance to poisoning, opening up new possibilities for efficient and sustainable desulfurization. -

Strategic Partnerships and Collaborations: Collaboration is key in navigating the complex world of refining. Companies like Honeywell are partnering with research institutions, equipment manufacturers, and refiners to share expertise, accelerate development, and tailor catalyst solutions to specific needs. -

Geographical Expansion: Established players like Clariant are entering new markets, particularly in Asia-Pacific and Latin America, driven by their high growth potential and rising demand for cleaner fuels. This capitalizes on existing expertise and expands reach to booming economies.

Factors Influencing Market Share:

-

Catalyst Performance and Efficiency: Companies with catalysts offering superior desulfurization activity, longer life, and broader feedstock compatibility hold a significant advantage. Factors like pore size, metal loading, and support material play crucial roles in determining performance. -

Cost-Effectiveness and Catalyst Life: Refineries prioritize cost-efficiency, and companies like Haldor Topsoe excel in offering catalysts with optimal performance at competitive prices. Additionally, longer catalyst life translates to reduced maintenance costs and operational efficiency. -

Regulatory Landscape and Environmental Compliance: Stringent environmental regulations regarding sulfur emissions are driving demand for highly efficient and eco-friendly catalysts. Companies compliant with these regulations gain a competitive edge. -

Technical Support and Service: Refineries require reliable technical support and services for catalyst selection, installation, and regeneration. Companies like Grace Davison excel in this area, offering comprehensive support packages to ensure optimal catalyst performance. -

Regional Market Dynamics: Demand for HDS catalysts varies across regions. Developed economies with stricter emission regulations and higher refining capacity remain dominant, while emerging markets offer significant growth potential as their refining infrastructure expands.

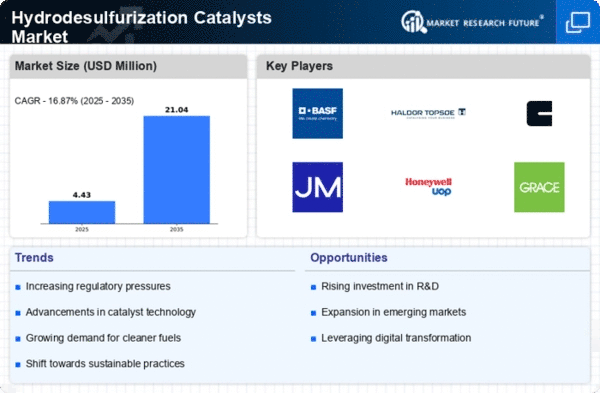

KEY PLAYERS

Albemarle Corporation (US)

China Petroleum & Chemical Corporation (China)

Johnson Matthey (UK)

Royal Dutch Shell PLC (Netherlands)

Axens (US)

Clariant AG (Switzerland)

Honeywell International Inc (US)

HaldorTopsoe (Denmark)

Chiyoda Corporation (Japan)

Dorf Ketal Chemicals (US)

JGC Catalysts and Chemicals Ltd (Japan)

UNICAT Catalyst Technologies, LLC (US)

Recent Developments:

-

August 2023: BASF unveils a new catalyst formulation with enhanced activity and resistance to poisoning, targeting heavy crude oil feedstocks. -

September 2023: The International Energy Agency releases new guidelines for cleaner fuel production, pushing refiners to adopt more efficient HDS technologies. -

October 2023: UOP announces a partnership with a leading refinery in China to develop and implement a custom-designed HDS catalyst solution for their specific crude oil blend. -

November 2023: Johnson Matthey introduces a nano-engineered catalyst with significantly improved desulfurization activity and reduced energy consumption. -

December 2023: Clariant acquires a promising HDS catalyst startup in India, expanding its reach and product portfolio in the high-growth Asian market.