Increasing Fuel Prices

The volatility of fuel prices is another factor that appears to be propelling the Hybrid EV Battery Market. As fuel costs rise, consumers are increasingly seeking alternatives that offer better fuel efficiency and lower operating costs. Hybrid vehicles, which combine an internal combustion engine with an electric motor, provide a compelling solution by reducing fuel consumption. This trend is likely to encourage more consumers to consider hybrid options, particularly in regions where fuel prices are consistently high. Consequently, the demand for hybrid batteries is expected to increase, further driving the Hybrid EV Battery Market.

Rising Environmental Concerns

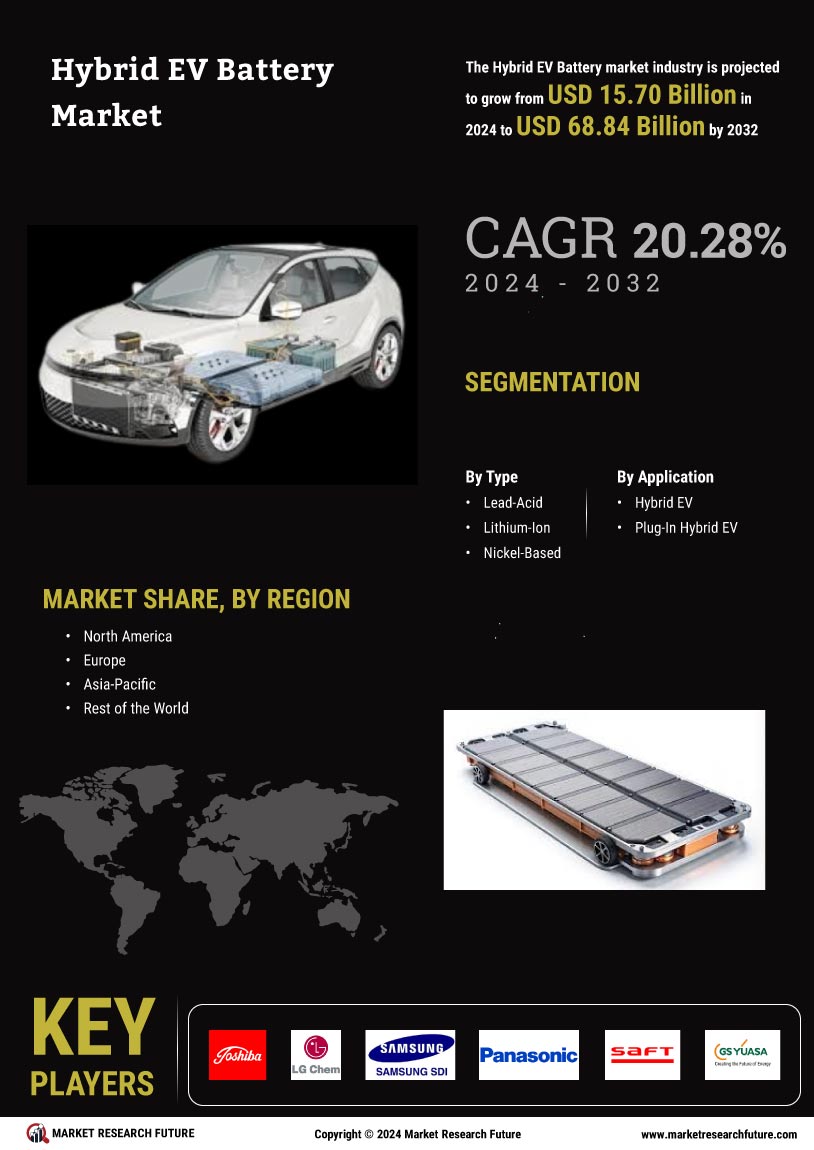

The increasing awareness of environmental issues appears to drive the Hybrid EV Battery Market. Consumers and governments alike are becoming more conscious of the impact of traditional vehicles on air quality and climate change. This shift in perception is likely to lead to a surge in demand for hybrid electric vehicles, which utilize advanced battery technologies to reduce emissions. According to recent data, the market for hybrid vehicles is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is expected to be fueled by the desire for cleaner transportation options, thereby enhancing the Hybrid EV Battery Market.

Advancements in Battery Technology

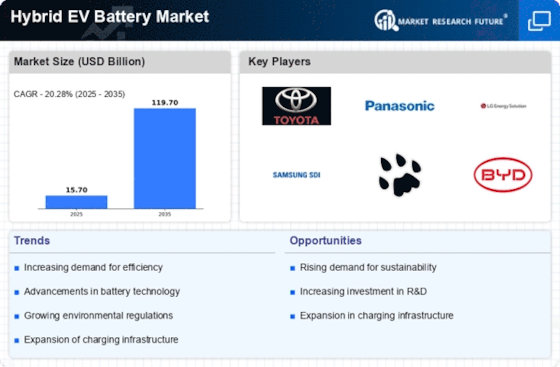

Technological innovations in battery chemistry and design are significantly influencing the Hybrid EV Battery Market. Recent developments in lithium-ion and solid-state batteries have improved energy density, charging speed, and overall efficiency. These advancements not only enhance vehicle performance but also reduce costs, making hybrid vehicles more accessible to a broader audience. As manufacturers continue to invest in research and development, the market is likely to witness a shift towards more efficient and longer-lasting battery solutions. This trend suggests that the Hybrid EV Battery Market will continue to evolve, driven by the need for better performance and sustainability.

Government Policies and Incentives

Government regulations and incentives play a crucial role in shaping the Hybrid EV Battery Market. Many countries have implemented policies aimed at reducing carbon emissions, which often include tax breaks, rebates, and subsidies for hybrid vehicle purchases. These initiatives encourage consumers to opt for hybrid solutions over traditional combustion engines. For instance, in several regions, incentives can reduce the overall cost of hybrid vehicles by up to 20%. Such financial support is likely to stimulate market growth, as consumers are more inclined to invest in environmentally friendly technologies, thereby bolstering the Hybrid EV Battery Market.

Growing Urbanization and Infrastructure Development

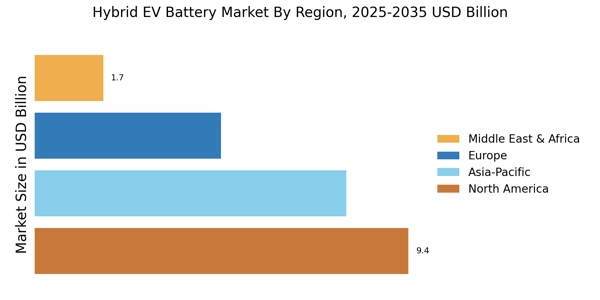

Urbanization trends and the development of infrastructure are likely to impact the Hybrid EV Battery Market positively. As cities expand, the demand for efficient and sustainable transportation solutions becomes more pressing. Urban areas often face challenges such as traffic congestion and pollution, prompting local governments to promote hybrid vehicles as a viable alternative. Additionally, the expansion of charging infrastructure is expected to facilitate the adoption of hybrid technologies. This growing urban focus on sustainability suggests that the Hybrid EV Battery Market will continue to thrive as cities seek to implement cleaner transportation solutions.