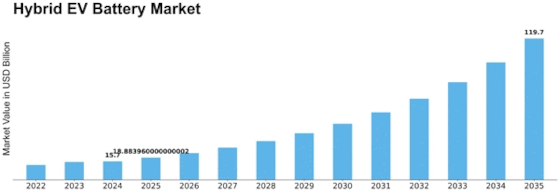

Hybrid Ev Battery Size

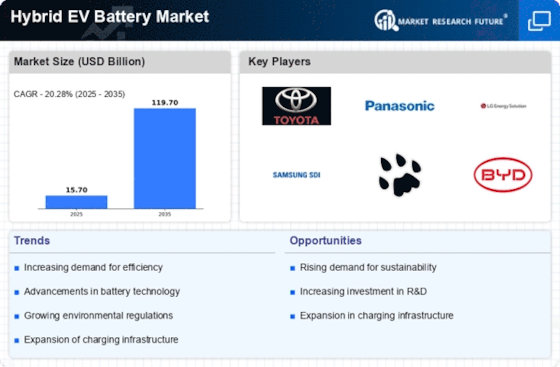

Hybrid EV Battery Market Growth Projections and Opportunities

The hybrid electric vehicle (HEV) battery market is intricately shaped by a combination of factors that collectively influence its growth and dynamics. One of the primary drivers of this market is the increasing global emphasis on sustainable and eco-friendly transportation solutions. With a growing awareness of environmental issues and the need to reduce carbon emissions, there is a rising demand for hybrid electric vehicles, propelling the market for their associated batteries. The shift toward cleaner transportation options aligns with global efforts to address climate change and promote greener mobility. The ongoing technological developments mark the pinnacle of shaping hybrid EV battery market. Continual advances in battery chemistry, energy density, and overall performance formulation help to generate increasingly reliable, cheaper hybrid vehicle batteries. Technologies like lithium-ion technology, solid-state batteries have revolutionized the way by a significant improvement in energy storage with hybrid evs and among consumer this has increased the use and turns out to be one of the promising factors in factor market growth. In terms of market origin, the hybrid EV battery market is driven by government policies and incentives which are policy related. Several countries in the world are making policies and providing monetary incentives to aid in speeding up the process of electric vehicles and hybrid vehicle use. Some of these policies involve tax credits, rebates and exemptions that can advocate customers to purchase hybrid electric vehicles. The regulatory element of this landscape is promotive in nature as it favors the manufacturers and nurtures market growth by boosting consumer confidence concerning hybrid technologies. The competitive landscape is a key element in shaping the hybrid EV battery Market. There is bitter competition among manufacturers; therefore there are constant innovations and ever continuing research and development activities of the same – to secure an advantage. Business is trying to optimize the battery efficiency, cut down recharging time and lengthen the useful life of HEV batteries. Competition includes several advantages to the consumers where they have choices and pave a way into advanced technologies that drive overall hybrid EV battery technology. Infrastructure projects are also driving the demand of market. The infrastructure of electric charging, specifically for the plug-in hybrid electric vehicles impacts both consumer confidence as well as adoption rates. The problem of charging stations, as well as the issue with range anxiety contributes to an increasing demand for hybrid EVs with government and private investments in such facilities promoting said market growth. Environmental awareness and corporate sustainability initiatives are also critical factors driving market trends. As businesses and individuals increasingly prioritize environmental responsibility, the demand for hybrid electric vehicles and their batteries grows. Manufacturers respond by incorporating eco-friendly practices, such as recyclability and reduced use of hazardous materials, into the production of hybrid EV batteries.

Leave a Comment