Market Growth Projections

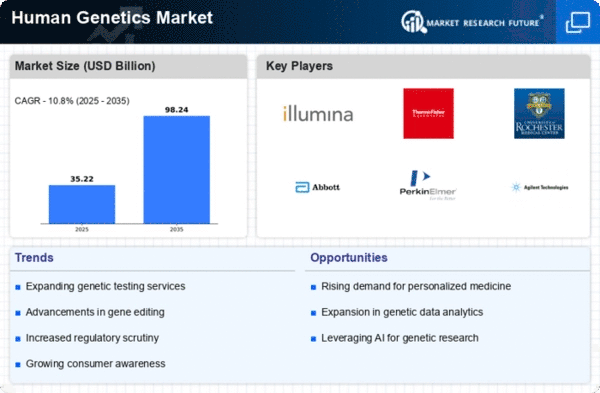

The Global Human Genetics Market Industry is poised for substantial growth, with projections indicating a market value of 31.8 USD Billion in 2024 and an anticipated rise to 98.2 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 10.8% from 2025 to 2035. The expansion is driven by various factors, including advancements in genetic testing technologies, increasing prevalence of genetic disorders, and the growing demand for personalized medicine. As the industry evolves, it is likely to attract further investments and innovations, solidifying its position as a critical component of modern healthcare.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in propelling the Global Human Genetics Market Industry forward. Various countries are investing in genetic research and healthcare infrastructure to enhance disease prevention and treatment strategies. For instance, the National Institutes of Health in the United States allocates substantial resources for genomic research, fostering innovation in genetic therapies. Such governmental support not only accelerates research but also encourages public-private partnerships, leading to the development of novel genetic solutions. This supportive environment is likely to contribute to the market's growth trajectory, with projections indicating a rise from 31.8 USD Billion in 2024 to 98.2 USD Billion by 2035.

Increasing Awareness and Education

The rising awareness and education regarding genetic health are vital drivers in the Global Human Genetics Market Industry. Public health campaigns and educational programs are informing individuals about the importance of genetic testing and its implications for health management. This heightened awareness is leading to increased demand for genetic services, as individuals seek proactive measures for disease prevention. Moreover, healthcare professionals are becoming more knowledgeable about genetic testing options, further driving adoption rates. As awareness continues to grow, the market is expected to expand significantly, with a valuation of 31.8 USD Billion in 2024 and a projected increase to 98.2 USD Billion by 2035.

Rising Prevalence of Genetic Disorders

The increasing incidence of genetic disorders globally drives the Global Human Genetics Market Industry. Conditions such as cystic fibrosis, sickle cell anemia, and various hereditary cancers are becoming more prevalent, necessitating advanced genetic testing and therapies. For instance, the World Health Organization reports that genetic disorders affect approximately 1 in 160 children globally. This growing demand for genetic diagnostics and personalized medicine is projected to contribute significantly to the market, with an estimated value of 31.8 USD Billion in 2024, and a forecasted growth to 98.2 USD Billion by 2035, reflecting a compound annual growth rate of 10.8% from 2025 to 2035.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is a pivotal driver in the Global Human Genetics Market Industry. Patients increasingly seek treatments tailored to their genetic profiles, enhancing therapeutic efficacy and minimizing adverse effects. This trend is evident in oncology, where targeted therapies based on genetic mutations have shown improved outcomes. The market's expansion is further supported by the increasing awareness of genetic testing among healthcare providers and patients. As a result, the market is projected to grow significantly, with a valuation of 31.8 USD Billion in 2024 and an expected rise to 98.2 USD Billion by 2035, indicating a robust CAGR of 10.8% from 2025 to 2035.

Advancements in Genetic Testing Technologies

Technological innovations in genetic testing are revolutionizing the Global Human Genetics Market Industry. The development of next-generation sequencing and CRISPR gene-editing technologies has enhanced the accuracy and efficiency of genetic analyses. These advancements allow for comprehensive genomic profiling, enabling early detection of diseases and tailored treatment plans. For example, companies are now offering whole-genome sequencing at reduced costs, making it accessible to a broader population. As these technologies continue to evolve, they are expected to drive market growth, contributing to the anticipated increase in market value from 31.8 USD Billion in 2024 to 98.2 USD Billion by 2035.