Rising Healthcare Expenditure

Rising healthcare expenditure is a significant driver of the Hospital Services Market. As countries allocate more resources to healthcare, hospitals are better positioned to enhance their services and infrastructure. Recent data indicates that healthcare spending has been increasing at an annual rate of approximately 5%, reflecting a growing commitment to improving health outcomes. This increase in funding allows hospitals to invest in state-of-the-art medical equipment, expand facilities, and hire additional staff, all of which contribute to improved patient care. Moreover, higher healthcare expenditure often correlates with increased access to services, which can lead to higher patient volumes and, consequently, greater revenue for hospitals. This trend underscores the importance of financial investment in the ongoing evolution of the Hospital Services Market.

Focus on Quality and Patient Safety

The emphasis on quality and patient safety is becoming increasingly prominent within the Hospital Services Market. Regulatory bodies and accreditation organizations are placing greater scrutiny on hospital performance metrics, which has led to a heightened focus on improving care standards. Hospitals are now investing in quality improvement initiatives and safety protocols to enhance patient experiences and outcomes. For example, hospitals that achieve high ratings in patient safety are often rewarded with increased funding and patient referrals. This focus on quality not only benefits patients but also positions hospitals competitively within the market. As a result, the drive for excellence in care delivery is likely to continue shaping the Hospital Services Market, influencing operational strategies and resource allocation.

Increased Prevalence of Chronic Diseases

The increased prevalence of chronic diseases is a pivotal driver of the Hospital Services Market. Conditions such as diabetes, heart disease, and obesity are on the rise, necessitating ongoing medical care and management. Recent statistics indicate that nearly half of the adult population is living with at least one chronic condition, which places a substantial burden on hospital services. This trend compels hospitals to enhance their capabilities in managing chronic diseases, including the development of specialized programs and multidisciplinary care teams. As the demand for chronic disease management grows, hospitals may need to adapt their service offerings to meet the needs of this patient population effectively. Consequently, the rising incidence of chronic diseases is likely to have a lasting impact on the Hospital Services Market.

Technological Advancements in Healthcare Delivery

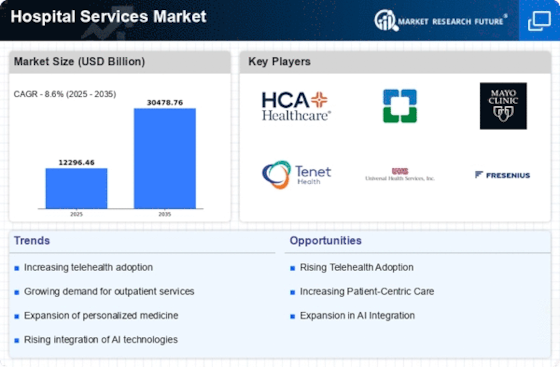

Technological advancements are reshaping the Hospital Services Market in profound ways. Innovations such as telemedicine, electronic health records, and robotic surgery are enhancing the efficiency and quality of care provided in hospitals. For instance, the adoption of telehealth services has surged, with a reported increase of over 50% in usage among healthcare providers. These technologies not only improve patient outcomes but also streamline hospital operations, potentially reducing costs. As hospitals integrate more advanced technologies, they are likely to attract a broader patient base, thereby driving growth in the Hospital Services Market. Furthermore, the ongoing development of artificial intelligence and machine learning applications in diagnostics and treatment planning may further revolutionize service delivery in hospitals.

Aging Population and Increased Demand for Services

The aging population is a critical driver of the Hospital Services Market. As individuals age, they typically experience a higher incidence of chronic diseases and require more frequent medical attention. This demographic shift is projected to increase the demand for hospital services significantly. According to recent estimates, the number of individuals aged 65 and older is expected to double by 2050, leading to a substantial rise in hospital admissions. This trend suggests that healthcare facilities must adapt to accommodate the growing needs of older patients, thereby influencing the overall landscape of the Hospital Services Market. Hospitals may need to expand their geriatric care services and invest in specialized training for staff to effectively manage the complexities associated with aging patients.